Top 10 Best Penny Stocks under 20 Rs. in India for 2024

Invest in undervalued stocks currently trading at below 20 Rupee, Best Multibagger Penny Stocks

Penny Stocks to invest under 20 Rs.: In the dynamic world of stock markets, penny stocks have always captured the imagination of investors looking for high-risk, high-reward opportunities. These stocks, typically priced under 20 Rs., can offer substantial returns if chosen wisely. For investors willing to tread cautiously and do their due diligence, penny stocks can present intriguing investment opportunities. In this blog, we’ll explore the top 10 best penny stocks under 20 Rs. in India for 2024.

We will know penny stocks India which are Top 10 Stocks to invest in 2024 under 20 Rupees but have the scope of moving steeply in future. Some of these top Indian Penny Stocks you may see in future trading among multibagger stocks. These are top 10 penny stocks which can perform outrageously in near future.

What is Penny Stock? Understanding Penny Stocks

Penny stocks, typically priced below 20 Rs., present a unique investment avenue for those seeking affordable yet potentially high-yield options. These stocks, often associated with smaller companies, can be a playground for savvy investors looking to capitalize on market trends and emerging opportunities.

Market Trends and Analysis:

Stay ahead of the curve by examining current market trends and analyzing the economic landscape. Our blog will provide insights into the factors influencing the Penny Stocks under 20 Rs. in India for 2024, helping you make informed decisions. Explore our curated list of the best penny stocks under 20 Rs. in India for the year 2024. We’ll break down each pick, highlighting key performance indicators, potential catalysts, and risks associated with each stock. This section aims to guide you in making well-informed investment choices aligned with your financial goals.

1. Harshil Agrotech Ltd. | Penny Stocks under 20 Rs.

Harshil Agrotech Ltd is an Indian agribusiness company primarily focused on the production and distribution of agricultural products and services. Established with a vision to enhance agricultural productivity and sustainability, Harshil Agrotech operates across various segments including crop cultivation, agrochemicals, seeds, and farming equipment. The company leverages modern agricultural practices and technologies to cater to the evolving needs of farmers and the agricultural sector.

Harshil Agrotech places a strong emphasis on research and development to develop innovative solutions that improve crop yields, enhance soil fertility, and mitigate environmental impact. Through its extensive network of distributors and retailers, the company ensures wide accessibility of its products to farmers across different regions of India. Committed to fostering long-term relationships with its customers and stakeholders, Harshil Agrotech continues to expand its product portfolio and strengthen its market presence in the agricultural industry.

Why to invest in this company?

- Company is almost debt free.

- Stock is trading at 0.51 times its book value

- Company’s working capital requirements have reduced from 250 days to 66.5 days

Fundamentals

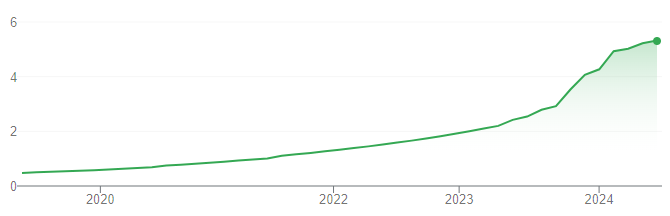

- Market Cap ₹ 5.75 Cr.

- Current Price ₹ 5.32

- High / Low ₹ 5.32 / 2.00

- Stock P/E 7.19

- Book Value ₹ 10.3

- Dividend Yield 0.00 %

- ROCE 86.2 %

- ROE 220 %

- Face Value ₹ 10.0

Harshil Agrotech Ltd. target Price: The share is expected to reach Rs. 7.35 levels in near future.

2. Franklin Industries Ltd | Penny Stocks under 20 Rs.

Franklin Industries Ltd is a diversified conglomerate operating in various sectors including manufacturing, infrastructure, and services. Headquartered in India, the company has a strong presence in both domestic and international markets.

Franklin Industries is known for its commitment to quality, innovation, and customer satisfaction across its product and service offerings. The company’s manufacturing division produces a wide range of industrial goods, including machinery, equipment, and components, catering to diverse industries such as automotive, construction, and electronics.

In addition, Franklin Industries has interests in infrastructure development, including real estate and construction projects, contributing to the growth and modernization of urban and rural landscapes. With a focus on sustainability and ethical business practices, Franklin Industries continues to expand its footprint while maintaining a reputation for reliability and excellence in the markets it serves.

Why to invest in this company?

- Company is almost debt free.

- Company is expected to give good quarter

Fundamentals

- Market Cap ₹ 19.8 Cr.

- Current Price ₹ 5.49

- High / Low ₹ 5.55 / 0.89

- Stock P/E 2.83

- Book Value ₹ 1.51

- Dividend Yield 0.00 %

- ROCE 70.7 %

- ROE 52.6 %

- Face Value 1.00

Franklin Industries Ltd. target Price: The share is expected to reach Rs. 6.95 levels in near future.

3. Rajvi Logitrade Limited

Rajvi Logitrade Limited is a dynamic logistics and trading company based in India, providing comprehensive solutions for transportation, warehousing, and trading services. With a commitment to efficiency and reliability, Rajvi Logitrade leverages its extensive network and industry expertise to facilitate seamless logistics operations for clients across various sectors.

The company specializes in offering customized logistics solutions tailored to meet the unique requirements of each client, ensuring timely delivery and cost-effectiveness. Rajvi Logitrade’s trading division focuses on sourcing and distributing a diverse range of products, including agricultural commodities, industrial goods, and consumer products, catering to domestic and international markets.

With a customer-centric approach and a dedication to excellence, Rajvi Logitrade Limited continues to expand its presence and enhance its services, striving to be a trusted partner for businesses seeking efficient logistics and trading solutions.

Fundamentals

- Market Cap ₹ 0.77 Cr.

- Current Price ₹ 7.67

- High / Low ₹ 7.67 / 6.33

- Stock P/E 1.92

- Book Value ₹ 0.80

- ROCE 51.7 %

- Face Value ₹ 10.0

Rajvi Logitrade Limited target Price: The share is expected to reach Rs. 9.65 levels in near future.

Explore | Top 10 Stocks to invest in 2024 Under 300 Rs

4. Tirupati Forge Ltd

Tirupati Forge Ltd is a prominent player in the automotive forging industry, specializing in manufacturing high-quality forged components for various automotive applications. Established in [year], the company has built a strong reputation for its expertise in producing critical components such as connecting rods, crankshafts, gears, and other engine and transmission parts.

With state-of-the-art manufacturing facilities equipped with modern technology and stringent quality control measures, Tirupati Forge ensures the production of durable and precision-engineered products. The company serves a diverse customer base, including leading automotive manufacturers both domestically and internationally.

Committed to innovation and excellence, Tirupati Forge focuses on continuous improvement and invests in research and development to stay at the forefront of technological advancements in the forging industry. With a dedication to customer satisfaction and adherence to industry standards, Tirupati Forge Ltd continues to be a trusted partner in the automotive forging sector.

Fundamentals

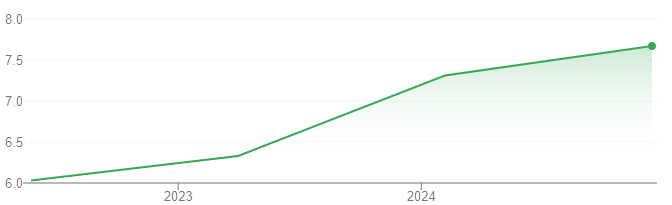

- Market Cap ₹ 167 Cr.

- Current Price ₹ 17.0

- High / Low ₹ 18.2 / 6.75

- Stock P/E 24.3

- Book Value ₹ 3.97

- ROCE 31.8 %

- ROE 29.2 %

- Face Value ₹ 2.00

Tirupati Forge Ltd target Price: The share is expected to reach Rs. 21.05 levels in near future.

Read Now | Top 10 Stocks To Invest Under 100 Rs.

5. Rajnandini Metal Ltd | Penny Stocks under 20 Rs.

Rajnandini Metal Ltd is a prominent player in the metal industry, recognized for its excellence in manufacturing and supplying a diverse range of metal products. Specializing in non-ferrous metals, the company is known for producing high-quality aluminum, copper, and zinc-based alloys. With a commitment to innovation and sustainability, Rajnandini Metal Ltd has positioned itself as a reliable source for various industries, including construction, automotive, and electrical sectors.

The company’s state-of-the-art manufacturing facilities adhere to stringent quality standards, ensuring that their products meet the specific requirements of clients. Rajnandini Metal Ltd’s dedication to customer satisfaction, coupled with a robust supply chain, has contributed to its success and established it as a trusted name in the metal manufacturing landscape.

Fundamentals

- Market Cap ₹ 417 Cr.

- Current Price ₹ 15.1

- High / Low ₹ 21.4 / 8.10

- Stock P/E 22.8

- Book Value ₹ 1.90

- Dividend Yield 0.42 %

- ROCE 29.2 %

- ROE 38.5 %

- Face Value ₹ 1.00

Rajnandini Metal Ltd target Price: The share is expected to reach Rs. 18.65 levels in near future.

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

6. Adroit Infotech Ltd

Adroit Infotech Ltd is a dynamic Indian IT company specializing in providing innovative software solutions and IT services to a diverse clientele. With a strong focus on technology-driven solutions, Adroit Infotech has carved a niche for itself in the competitive IT landscape. The company offers a wide range of services, including software development, application maintenance, system integration, and consulting services, catering to various industries such as healthcare, finance, retail, and manufacturing.

Adroit Infotech prides itself on its commitment to delivering high-quality solutions that align with clients’ business objectives and drive operational efficiency. Leveraging its team of skilled professionals and cutting-edge technologies, the company strives to stay at the forefront of technological advancements and industry trends.

With a customer-centric approach and a track record of successful project implementations, Adroit Infotech has earned the trust and confidence of its clients. As it continues to expand its offerings and explore new avenues for growth, Adroit Infotech remains dedicated to delivering excellence in IT solutions and services.

Fundamentals

- Market Cap ₹ 98.3 Cr.

- Current Price ₹ 18.2

- High / Low ₹ 25.0 / 11.6

- Book Value ₹ 3.67

- ROCE 23.2 %

- ROE 28.2 %

- Face Value ₹ 10.0

Adroit Infotech Ltd target Price: The share is expected to reach Rs. 20.95 levels in near future.

Read Now | Top 10 Best Personal Loan Apps for low CIBIL Score

7. GTL Infrastructure | Penny Stocks under 20 Rs.

Overview : GTL Infrastructure Ltd. is involved in providing passive telecom infrastructure to wireless telecom operators. This includes services related to towers, such as tower installation, maintenance, and sharing. The company plays a crucial role in supporting the expansion of mobile networks in India.

GTL Infrastructure focuses on leasing and managing telecom towers, enabling telecom operators to reduce capital expenditure and optimize operational costs. The company is part of the larger GTL Group, which has interests in various sectors, including telecommunications.

Fundamentals

- Market Cap ₹ 2,869 Cr.

- Current Price ₹ 2.24

- High / Low ₹ 2.24 / 0.60

- Face Value₹ 10.0

GTL Infrastructure target Price: The share is expected to reach Rs. 3.90 levels in near future.

8. Nila Infrastructures Ltd | Penny Stocks under 20 Rs.

Business Focus: Nila Infrastructures Ltd is known for its involvement in various infrastructure projects, including real estate, urban infrastructure, and industrial infrastructure. They have worked on projects such as residential and commercial developments, industrial parks, and more. Nila Infrastructures is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE).

Fundamentals

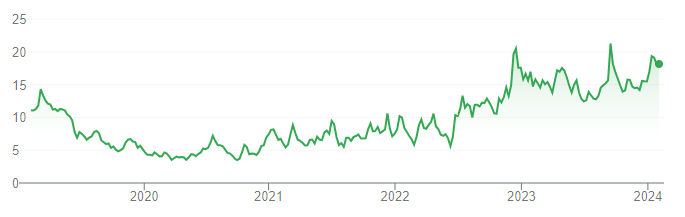

- Market Cap ₹ 500 Cr.

- Current Price ₹ 12.7

- High / Low ₹ 12.7 / 4.23

- Stock P/E 188

- Book Value ₹ 3.44

- ROCE 6.05 %

- Face Value ₹ 1.00

Nila Infra target Price: The share is expected to reach Rs. 15.80 levels in near future.

Explore | Top 10 Penny Stocks to invest under Rupee 1

9. Comfort Intech Ltd | Penny Stocks under 20 Rs.

Incorporated in 1994, Comfort Intech Ltd trades in various goods and services and manufactures liquor. It also trades in fans, fabrics, water heaters, and monoblock pumps, as well as consumer appliances and durables, home appliances and electronics, textiles, etc.

Also, it engages in the immovable property leasing services; trading of shares and mutual funds; and financing activities. It sells its products on e-commerce marketplace platforms, as well as through the immediate suppliers of the marketplace platforms. The company was formerly known as Comfort Finvest Limited.

Fundamentals

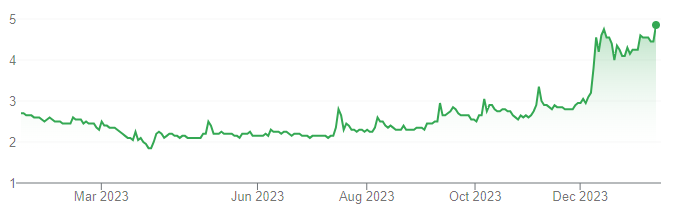

- Market Cap ₹ 300 Cr.

- Current Price ₹ 9.38

- High / Low ₹ 10.2 / 2.34

- Stock P/E 22.9

- Book Value ₹ 4.16

- Dividend Yield 0.64 %

- ROCE 6.84 %

- ROE 5.80 %

- Face Value ₹ 1.00

Comfort Intech Ltd target Price: The share is expected to reach Rs. 13.80 levels in near future.

10. FCS Software Solutions Ltd

FCS Software Solutions is an integrated technology services provider with a focus on IT consulting, software development, and business process outsourcing. The company offers a range of services, including software development, application maintenance, testing, infrastructure management, and business process outsourcing. FCS Software Solutions serves clients across various industries, including banking and finance, healthcare, telecommunications, manufacturing, and more.

Fundamentals

- Market Cap ₹ 1,077 Cr.

- Current Price ₹ 6.30

- High / Low ₹ 6.69 / 1.84

- Stock P/E 595

- Book Value ₹ 2.09

- ROCE 0.96 %

- ROE 0.35 %

- Face Value ₹ 1.00

FCS Software Solutions Ltd target Price: The share is expected to reach Rs. 9.80 levels in near future.

Conclusion

Furthermore, diversification remains key to managing risk in any investment portfolio. Investors should allocate only a portion of their portfolio to penny stocks and balance it with more stable and established investments.

While penny stocks under 20 Rs. in India for 2024 present opportunities for substantial gains, they require careful consideration and risk management. With thorough research and prudent investing strategies, investors can navigate the penny stock market and potentially unlock attractive returns.

While these penny stocks hold potential, it’s crucial to remember that investing in them comes with significant risks. Penny stocks are often subject to speculative trading, liquidity issues, and company-specific challenges. Therefore, investors should conduct thorough research, analyze financials, assess industry trends, and consider consulting with financial advisors before investing in penny stocks.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator