Small Cap Low PE Stocks To Buy Today Under 100 Rs.

Low PE Stocks To Buy Today Under 100 Rs. in India: Investing in the stock market can be a daunting task, especially for those who are just starting out or have limited funds to invest. However, one strategy that many investors find attractive is to look for small-cap stocks with low price-to-earnings (PE) ratios. These stocks often have significant growth potential and can be purchased at relatively low prices, making them appealing options for investors with limited capital.

In India, where the stock market is dynamic and diverse, there are several small-cap stocks trading below Rs. 100 with attractive PE ratios. Investors may consider adding these undervalued stocks to their portfolios. Here, we explore some of these stocks and the reasons why they could be worth considering for investment.

Understanding Small Cap Stocks

Small-cap stocks typically refer to companies with a relatively small market capitalization, often ranging from a few crores to a few hundred crores. These companies are at an early stage of development in comparison to large-cap or mid-cap companies, and as such, they often carry higher risk but also the potential for substantial returns.

The Appeal of Low PE Ratios:

The price-to-earnings ratio, or PE ratio, is a common metric to evaluate the valuation of a company’s stock. It is calculated by dividing the current market price of a stock by its earnings per share (EPS). A low PE ratio suggests that a stock may be undervalued relative to its earnings potential. Hence, making it an attractive proposition for value investors.

1. Jyoti Structures Limited (JYOTISTRUC) | Small Cap Low PE Stocks

CMP: 22.05 INR (1,060.53% up in past 5 years)

Jyoti Structures Limited is engaged in the design, manufacture, and installation of power transmission towers and substation structures. Despite facing challenges in recent years, the company has shown signs of improvement with its restructuring efforts and focus on operational efficiency. With a PE ratio of under 5 and a price below Rs. 100, JYOTISTRUC presents an opportunity for investors seeking exposure to the infrastructure sector at an attractive valuation.

The stock has performed extremely well and experts are stills seems bullish in this share. The stock may reach levels of Rs. 30 in near future.

2. RattanIndia Power Limited (RTNPOWER) | Small Cap Low PE Stocks

CMP: 8.90 INR (229.63% up in past 5 years)

RattanIndia Power Limited is involved in the generation and supply of electricity through thermal and renewable energy sources. The company has been expanding its renewable energy portfolio, which bodes well for its long-term growth prospects, given the increasing focus on clean energy. With a low PE ratio and a stock price below Rs. 100, RTNPOWER offers investors an opportunity to capitalize on the growing demand for renewable energy in India.

The stock has given very good return to investors and may reach to the levels of Rs. 12.05 in near future.

3. Parsvnath Developers Limited (PARSVNATH)

CMP: 12.40 INR (100.00% up in past 5 years)

Parsvnath Developers Limited is a real estate development company that is involved in residential, commercial, and retail projects across India. Despite facing headwinds in the real estate sector, Parsvnath Developers has been making efforts to reduce debt and streamline its operations. With a PE ratio below 10 and a stock price below Rs. 100, PARSVNATH could be an attractive option for investors betting on a revival in the Indian real estate market.

The stock has doubled the investors money however it is expected that the stock may reach to the levels of Rs. 22 in near future.

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

4. Manaksia Steels Limited (MANAKSTEEL)

CMP: 58.65 INR (172.16% up in past 5 years)

Manaksia Steels Limited is engaged in the manufacturing and distribution of steel products, including roofing sheets, cold rolled coils, and galvanized corrugated sheets. The company has been benefiting from the revival in the infrastructure and construction sectors, driven by government initiatives such as “Make in India” and increased infrastructure spending. With a low PE ratio and a stock price below Rs. 100, MANAKSTEEL presents an opportunity for investors to gain exposure to the growing demand for steel in India.

The stock is performing really well and having steady growth data. The stock may reach to the level of Rs. 85 in near future.

5. Suzlon Energy Ltd (SUZLON) | Small Cap Low PE Stocks

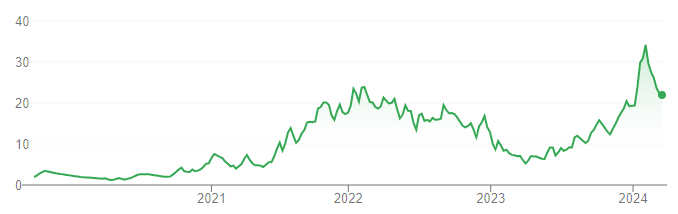

CMP: 37.50 INR (563.72% up in past 5 years)

SCI is a major player in the shipping industry, offering services in both domestic and international waters. Despite the cyclical nature of the shipping business, SCI has managed to maintain a steady performance. With a low PE ratio and the potential for growth in global trade, SCI presents an attractive investment opportunity.

The stock has performed tremendously and expected to reach at 52 Rs. in near future.

Conclusion

Investing in small-cap stocks with low PE ratios can be a rewarding strategy for investors seeking opportunities in the Indian stock market. While these stocks may carry higher risk due to their small size and lower liquidity, they also have the potential to deliver significant returns over the long term.

However, it’s essential for investors to conduct thorough research and analysis before investing in any stock, considering factors such as the company’s financial health, growth prospects, and industry dynamics. By carefully selecting small-cap stocks with low PE ratios trading below Rs. 100, investors can build a diversified portfolio with the potential for substantial growth.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator