Top Multibagger Penny Stocks To Invest Today | Midcap Stocks

Multibagger Penny Stocks: Penny stocks have always intrigued investors with their potential for massive returns. In the Indian stock market, these low-priced equities often garner attention due to their affordability and the possibility of substantial gains.

Among the various segments of the stock market, midcap Multibagger Penny Stocks often stand out as potential multibaggers, offering investors an opportunity to capitalize on their growth potential. Here, we explore some Indian midcap penny stocks that investors may consider for their portfolios today.

Understanding Penny Stocks and Midcap Multibaggers

Before delving into specific stock picks, it’s crucial to understand what penny stocks and midcap multibaggers entail.

Penny Stocks: Penny stocks typically refer to stocks with low market capitalization, usually trading at a relatively low price per share, often below Rs. 10 or Rs. 20 in the Indian context. These stocks are characterized by high volatility and liquidity constraints, making them risky investments. However, they can also offer substantial returns if chosen wisely.

Midcap Multibaggers: Midcap stocks belong to companies with a medium market capitalization, falling between large-cap and small-cap stocks. Multibaggers are stocks that have the potential to multiply in value several times over the long term. Identifying midcap multibaggers requires identifying companies with strong fundamentals, growth prospects, and competent management teams.

Top Indian Penny Stocks to Invest in the Midcap Segment

Suzlon Energy Limited (SUZLON) | Multibagger Penny Stocks to Inevst

CMP: 36.40 INR (+366.67%) past year

Suzlon Energy Limited is a key player in the renewable energy sector, specializing in wind turbine manufacturing and installation. With a focus on sustainability and clean energy solutions, Suzlon stands to benefit from India’s ambitious renewable energy targets. Despite facing financial challenges in the past, the company has been restructuring its operations and could potentially capitalize on the growing demand for renewable power sources.

The company has performed extremely well in past year and has fetched 366% return. This means the stock has tripled the investors money in past one year. Experts are still bullish on the stock. The stock may reach to the levels of Rs. 52 in near future.

Suven Life Sciences Limited (SUVEN) | Top Midcap stock to invest in India

CMP: 117.75 INR (+278.01%) past year

Suven Life Sciences is a leading contract research and manufacturing organization (CRMO) focused on drug discovery and development. With a robust pipeline of new molecules and partnerships with global pharmaceutical companies, Suven presents significant growth opportunities. The company’s consistent performance and focus on innovation make it an attractive midcap penny stock for investors seeking exposure to the pharmaceutical sector.

The stock is up by approx 98% in one year and has doubled the money of investors.

Top Competitors of the company are Sun Pharma, Cipla, Dr Reddys Labs, Zydus Life etc.

The stock may perform to the level of Rs. 188 in near future.

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

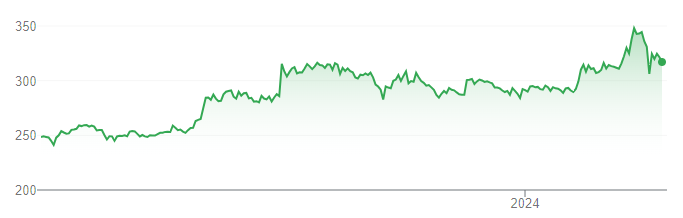

V-Guard Industries Limited (VGUARD) | Multibagger Midcap Stocks to invest

CMP: 317.40 INR (+27.80%) past year

V-Guard Industries is a prominent player in the electrical appliances and consumer goods segment. The company has a strong distribution network and a diverse product portfolio, including voltage stabilizers, inverters, pumps, and electrical cables. With increasing demand for its products and expansion plans in both domestic and international markets, V-Guard offers promising growth potential for investors.

The stock is up by more than 28% in past year. However the experts are still bullish on the stock and this stock may reach up to the levels of Rs. 418 in coming days.

TeamLease Services Limited (TEAMLEASE)

CMP: 2,739.00 INR (+20.66%) past year

TeamLease Services is India’s leading staffing and human resource services company, offering a range of solutions such as temporary staffing, permanent recruitment, payroll outsourcing, and skill development. With the growing trend of outsourcing and flexible employment models, TeamLease is well-positioned to capitalize on the evolving workforce dynamics in India. The company’s efficient business model and strong industry presence make it an attractive midcap penny stock for investors bullish on the staffing sector.

The stock has performed well in past year. This is up by 20% in past year. The company stock may reach to Rs. 3200/- in near future.

Peer competitors of the company are Info Edge, Jyoti CNC Auto, Inox India, Quess Corp.

Endurance Technologies Limited (ENDURANCE)

CMP: 1,763.90 INR (+40.19%) past year

Endurance Technologies is a leading manufacturer of automotive components, catering to both two-wheeler and four-wheeler segments. The company’s diverse product portfolio includes aluminum die-castings, suspensions, transmissions, and braking systems. Endurance benefits from its strong relationships with major automotive OEMs and its focus on technological innovation and quality. With the expected growth in the Indian automotive industry and increasing demand for lightweight and fuel-efficient components, Endurance presents compelling investment opportunities for midcap investors.

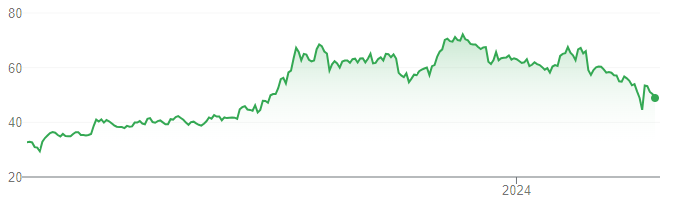

Jain Irrigation Systems Limited (JISLJALEQS)

CMP: 49.00 INR (+49.62%) past year

Jain Irrigation Systems Limited is a prominent name in the agricultural sector, providing innovative irrigation solutions and products. As agriculture continues to be a vital part of India’s economy, companies like Jain Irrigation stand to benefit from increasing demand for efficient water management systems. Although the company has faced challenges in the past, strategic initiatives and a focus on technology-driven solutions could pave the way for future growth.

The stock has performed well in past year. The stock may reach to the level of Rs. 72 in upcoming days.

Key Considerations for Investing in Multibagger Penny Stocks

While penny stocks can offer lucrative returns, investors should approach them with caution and consider the following factors:

- Fundamental Analysis: Conduct thorough research into the company’s financials, business model, management team, industry dynamics, and growth prospects before investing.

- Risk Management: Allocate only a small portion of your portfolio to penny stocks to mitigate risks associated with their high volatility and speculative nature.

- Diversification: Spread your investments across multiple penny stocks and other asset classes to reduce concentration risk and enhance portfolio resilience.

- Long-Term Perspective: Invest in penny stocks with a long-term horizon, focusing on companies with strong fundamentals and sustainable growth drivers.

Conclusion

Investing in Indian midcap penny stocks can be rewarding for investors willing to undertake thorough research and manage risks effectively. While these stocks offer the potential for multibagger returns, they also carry higher risks compared to established blue-chip companies. Therefore, investors should exercise caution, conduct comprehensive due diligence, and diversify their portfolios to maximize returns and mitigate risks in the volatile world of penny stocks.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator