Top BankNifty Shares Under 100 Rs. To Invest today

BankNifty Shares Under 100: In the realm of financial markets, the BankNifty holds a significant position, often dictating the sentiment of the broader market. Understanding BankNifty charts, share prices, and predictions can provide valuable insights for investors.

In this article, we delve into the world of BankNifty shares, focusing on stocks priced affordably under ₹100. We’ll explore their potential, considering factors such as live BankNifty updates, weightage, and today’s share prices.

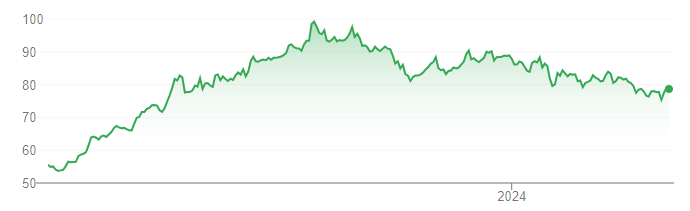

IDFC First Bank (IDFCFIRSTB)

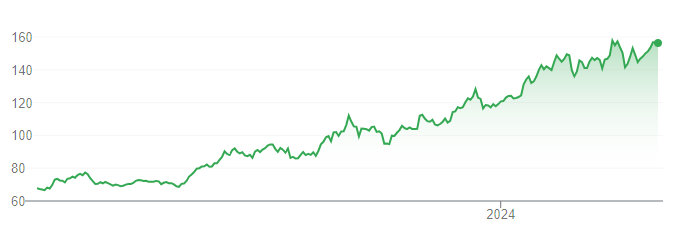

IDFC First Bank is a notable player in the BankNifty universe, with its share price and performance closely tracked by investors. As per BankNifty predictions, IDFCFIRSTB holds potential for growth, making it an enticing option for investors monitoring BankNifty charts and stock lists.

Despite its low price, the bank has shown resilience and potential for growth, making it an attractive option for investors seeking value at an affordable price.

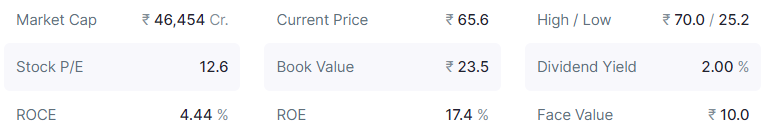

IDFC First Bank Financials Data

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

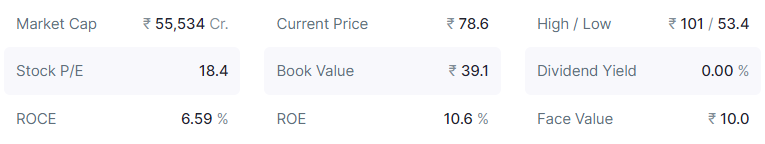

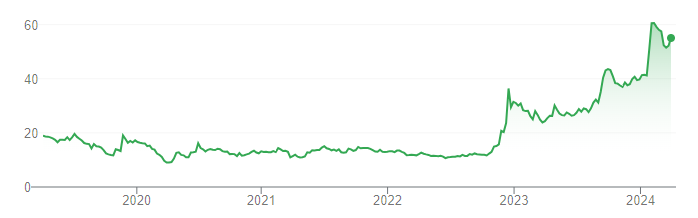

Indian Overseas Bank (IOB) | BankNifty Shares Under 100

Indian Overseas Bank is another noteworthy inclusion in the list of BankNifty shares under ₹100. With a renewed focus on digital banking and customer-centric services, IOB is poised for growth in the coming years, offering investors an opportunity to ride the wave of transformation in the banking industry.

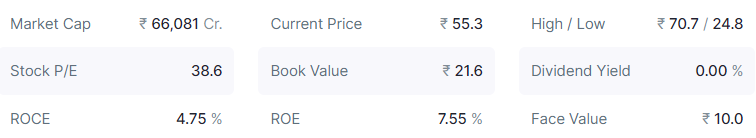

IOB Financials Data

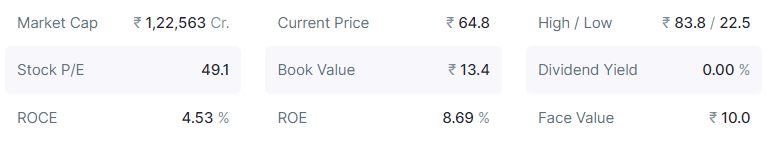

Central Bank of India (CENTRALBK) | BankNifty Shares Under 100

Central Bank of India boasts a rich legacy and a strong presence across the country. Despite facing headwinds in the past, the bank has undertaken strategic initiatives to enhance its operational efficiency and strengthen its balance sheet, making it an attractive investment proposition for discerning investors.

CENTRALBK Financials Data

Bank of Maharashtra (MAHABANK)

Bank of Maharashtra is a regional powerhouse with a focus on serving the needs of customers in Maharashtra and beyond. With a prudent approach to risk management and a diversified product portfolio, MAHABANK offers investors an opportunity to tap into the potential of emerging markets.

MAHABANK Financial Data

Union Bank of India (UNIONBANK) | BankNifty Shares Under 100

Union Bank of India is a leading public sector bank with a strong foothold in both retail and corporate banking segments. Despite market volatility, UNIONBANK has demonstrated resilience and adaptability, making it a compelling investment choice for long-term investors.

UNIONBANK Financial Data

UCO Bank (UCOBANK)

UCO Bank is known for its customer-centric approach and innovative product offerings. With a focus on digital transformation and enhancing operational efficiency, UCOBANK is well-positioned to capitalize on emerging opportunities in the banking sector, making it an attractive investment option at its current price level.

UCOBANK Financial Data

Conclusion

Investing in BankNifty shares under ₹100 offers investors an opportunity to diversify their portfolios and capitalize on the growth potential of the banking sector. While these stocks may come with their own set of risks, thorough research and a long-term investment horizon can help mitigate potential downsides. By considering the top 10 BankNifty shares highlighted in this article, investors can make informed decisions and embark on a journey towards wealth creation in the dynamic world of finance.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator