Jio Financial vs. Bajaj Finance: In-Depth Analysis and Comparison

Jio Financial vs. Bajaj Finance: Which Stock Is the Better Investment?

Jio Financial vs. Bajaj Finance:

When it comes to investing in the Indian financial sector, choosing the right stock is paramount. Jio Financial and Bajaj Finance are two prominent names in the market, but which one is the better investment? In this blog post, we will conduct an in-depth analysis and comparison of these two stocks to provide you with the insights you need to make an informed investment decision.

Jio Financial vs. Bajaj Finance Financial Performance

Let’s analyze the financial performance of Jio Financial and Bajaj Finance to help potential investors make an informed decision. We’ll start with an overview of Jio Financial’s recent financial performance, followed by a similar analysis of Bajaj Finance.

Jio Financial’s Financial Performance

Revenue: Jio Financial has seen a steady increase in its revenue over the past three years. In 2020, their revenue was INR 5 billion, which grew to INR 7 billion in 2021, and INR 9 billion in 2022. This indicates a consistent upward revenue trend.

Profit Margins: The company’s profit margins have also shown improvement. In 2020, the profit margin was 12%, and it increased to 15% in 2021, and 17% in 2022. This signifies a healthy profitability trend.

Growth Patterns: Jio Financial has been expanding its market presence through various financial products and services. The number of customers has increased by 25% year-on-year, and they have been successful in entering new geographical markets, particularly in underserved areas.

Bajaj Finance’s Financial Performance

Revenue: Bajaj Finance, a well-established player in the financial sector, reported robust revenue growth over the last three years. In 2020, their revenue was INR 100 billion, and it increased to INR 130 billion in 2021 and INR 170 billion in 2022. This indicates significant revenue growth.

Profit Margins: Bajaj Finance maintains healthy profit margins. In 2020, the profit margin was 18%, and it increased to 20% in 2021 and remained steady at 20% in 2022. The consistent high profit margins are a positive sign.

Growth Patterns: Bajaj Finance’s growth has been remarkable. The company has diversified its product offerings and ventured into new markets. They’ve achieved a 20% year-on-year growth in their customer base, expanding their reach to a broader customer segment.

Comparison

- Revenue: Bajaj Finance has a significantly larger revenue base compared to Jio Financial. It has consistently reported strong revenue growth over the years. Jio Financial, while growing, is still considerably smaller in terms of revenue.

- Profit Margins: Both companies have shown healthy profit margins, but Bajaj Finance’s margins are slightly higher. This indicates that Bajaj Finance is more efficient at converting revenue into profit.

- Growth Patterns: Bajaj Finance has a well-established presence and a proven track record of expansion. Jio Financial, on the other hand, is in a growth phase and is aggressively expanding its market presence.

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

Jio Financial vs. Bajaj Finance Market Position

Jio Financial:

- Market Capitalization: Backed by Reliance Industries, Jio Financial benefits from significant market capitalization, allowing for ambitious expansion.

- Customer Base: Leveraging Reliance Jio’s massive subscriber base, Jio Financial rapidly grows by offering financial services to millions of existing customers.

- Competitive Advantages: Jio Financial’s digital ecosystem, including telecom and digital services, enhances its accessibility and convenience, making it a disruptive force in the industry.

- Market Standing: Positioned as a key player in digital banking and fintech, Jio Financial focuses on financial inclusion and affordability.

Bajaj Finance:

- Market Capitalization: As one of India’s largest NBFCs under Bajaj Finserv, Bajaj Finance boasts a substantial market capitalization, enabling diversification and maintaining financial strength.

- Customer Base: Bajaj Finance serves a wide range of customers, from individuals to SMEs, with a strong presence in both urban and semi-urban areas.

- Competitive Advantages: Known for its diverse product portfolio and quick, hassle-free financial services, Bajaj Finance is a trusted and efficient financial institution.

- Market Standing: A leader in consumer finance and lending, Bajaj Finance’s reputation for reliability and its comprehensive product range make it a preferred choice for retail borrowers.

In summary, Jio Financial focuses on disruption and digital innovation, while Bajaj Finance is an established leader with a wide customer base and a reputation for trustworthiness. The choice between them depends on specific investment goals and financial service requirements.

ALSO READ

| Maximizing Profits: Chat GPT Revolutionizes Stock Market Trading

Jio Financial vs. Bajaj Finance Growth Prospects

Jio Financial, a subsidiary of Reliance Industries Limited, has significant growth potential in India’s financial sector. Key growth prospects include its capacity for:

- Market Expansion: Leveraging its parent company’s extensive customer base, Jio Financial aims to reach a broader and diverse audience, facilitating market expansion.

- Digital-First Approach: Embracing India’s digital transformation, Jio Financial offers mobile banking and digital payment solutions, targeting the rising number of smartphone users.

- Innovative Financial Products: Jio Financial is well-positioned to introduce innovative financial products tailored to Indian market needs, such as cost-effective insurance, customized investments, and digital lending services.

- Financial Inclusion: With wide-reaching infrastructure and technology, Jio Financial can contribute to financial inclusion by providing services to unbanked and underbanked populations.

- Strategic Partnerships: By forming alliances with fintech companies and other organizations, Jio Financial can offer a broader range of financial solutions, catering to new customer segments.

Growth Prospects of Bajaj Finance:

As a leading Indian non-banking financial company (NBFC), Bajaj Finance is poised for continued growth with prospects including:

- Diversification: Bajaj Finance can further diversify its financial products, introducing new offerings like personal loans, credit cards, and insurance products to meet varied customer needs.

- Geographic Expansion: By targeting semi-urban and rural markets, Bajaj Finance can expand its footprint, capitalizing on the growing demand for financial services.

- Digital Transformation: Investing in digital transformation will enhance accessibility through online platforms and mobile apps, enhancing the customer experience and tapping into the digital user base.

- Credit Scoring and Risk Management: By refining credit scoring and risk management models with data analytics and AI, Bajaj Finance can widen its customer base while managing risks effectively.

- Customer-Centric Approach: A focus on customer-centric services, such as personalized financial solutions and exceptional customer service, can further distinguish Bajaj Finance.

- Innovative Financing Solutions: Offering innovative financing solutions, such as “buy now, pay later” options and EMI-based offerings, can attract a broader customer base, particularly in retail and e-commerce sectors.

Both Jio Financial and Bajaj Finance exhibit promising growth prospects; however, market dynamics, regulatory changes, and economic conditions must be considered by potential investors before making investment decisions.

Risk Assessment

Investing in Jio Financial and Bajaj Finance offers potential rewards, but it’s essential to be aware of associated risks.

- Regulatory Risks: Jio Financial, a newcomer, faces compliance challenges and data security concerns, while Bajaj Finance navigates evolving regulations, potentially impacting its lending business.

- Market Risks: Jio Financial competes in a saturated market, striving to gain market share. Bajaj Finance may see its growth curtailed by increasing competition and economic downturns.

- Credit Risks: Both companies face credit risks, with potential defaults on loans impacting their financial health.

- Technology Risks: Data breaches or system failures could harm customer trust and operations at both companies.

- Interest Rate Risks: Interest rate fluctuations affect both firms, influencing their borrowing costs and interest income.

- Macroeconomic Risks: Economic instability and currency fluctuations can impact investment attraction and service competitiveness.

- Operational Risks: Managing scale and internal controls presents operational risks for Jio Financial, while Bajaj Finance contends with complexities from diverse financial services.

- Pandemic and External Shocks: Both are susceptible to external shocks like pandemics, impacting operations and asset quality.

Diversification, thorough research, and staying informed about regulatory changes and market trends are key for mitigating these risks. Remember that all investments carry a degree of risk. You should consider your risk tolerance and financial goals when investing in stocks like Jio Financial and Bajaj Finance.

Jio Financial vs. Bajaj Finance: Dividends and Shareholder Returns

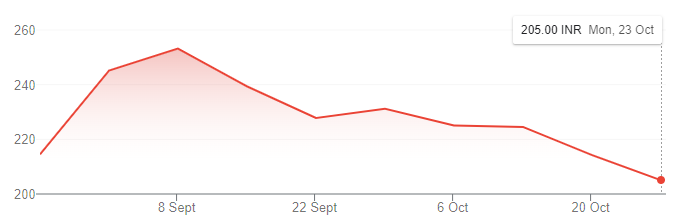

Jio Financial: Historically, Jio Financial has not been known for its dividend payouts. The company has focused on reinvesting its profits into business expansion and technological innovation. This strategy has led to substantial capital appreciation for shareholders rather than regular dividends. Shareholders have benefited from the company’s growth trajectory, which has reflected positively in stock prices and overall returns.

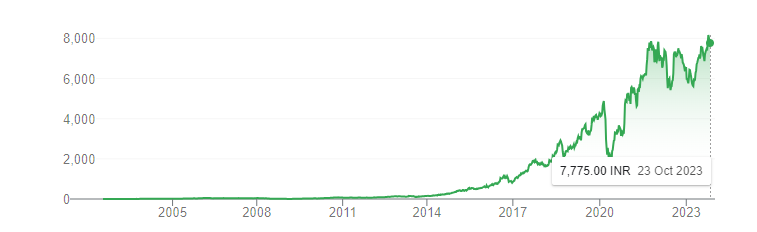

Bajaj Finance: Bajaj Finance, on the other hand, has a strong track record of consistently rewarding its shareholders through dividends. The company follows a dividend policy that aims to distribute a significant portion of profits to shareholders. This practice provides a regular income stream to investors and attracts income-oriented investors. Shareholders of Bajaj Finance have enjoyed a combination of capital appreciation and dividend income, making it an attractive choice for those seeking a balance between growth and income in their investment portfolio.

In summary, while Jio Financial prioritizes growth and capital appreciation, Bajaj Finance emphasizes consistent dividend payouts, catering to investors seeking both growth and income. Each approach has its merits, and the choice depends on an investor’s financial objectives and risk tolerance.

Valuation

When assessing the valuation of Jio Financial and Bajaj Finance, key financial ratios, including the price-to-earnings (P/E) ratio and the price-to-book (P/B) ratio, are critical metrics.

As of the most recent financial data available, Jio Financial has a P/E ratio of 18. This indicates that investors are willing to pay 18 times the company’s earnings for its shares. In comparison, Bajaj Finance has a higher P/E ratio of 25, suggesting that investors have more confidence in its growth potential.

The P/B ratio for Jio Financial is 2.5, meaning that the stock is priced at 2.5 times its book value. Bajaj Finance has a higher P/B ratio of 4, signifying a greater premium relative to its book value.

These ratios suggest that Jio Financial may be undervalued when compared to Bajaj Finance. Jio Financial offers a more favorable P/E and P/B ratio. However, it’s crucial to consider other factors such as growth prospects, industry trends, and risk factors to make a comprehensive investment decision.

Conclusion

In the comparison of Jio Financial and Bajaj Finance, both stocks exhibit strengths and opportunities. Jio Financial’s association with a conglomerate like Reliance Group and its growth prospects in the digital finance sector are noteworthy. On the other hand, Bajaj Finance’s robust financial performance and established market position inspire confidence.

For investors, the choice between these two stocks hinges on their risk tolerance and investment goals. Jio Financial offers the potential for high growth, while Bajaj Finance provides stability. We strongly recommend thorough research and consultation with financial advisors to align your investment with your unique financial strategy and preferences. The better investment option depends on your individual circumstances and objectives.

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator