IDBI Share price: Trend, Analysis and Future Prediction

Understanding the Dynamics of IDBI Bank Share Price in 2024

IDBI Share price: In the ever-evolving landscape of the financial market, keeping a close eye on the performance of prominent banking institutions is crucial for investors and stakeholders. IDBI Bank, a key player in the Indian banking sector, has been subject to fluctuating trends and market dynamics. Let’s delve into the current status of IDBI Bank’s share price and the factors influencing its trajectory in 2024.

The IDBI Bank Limited is a development finance institution under the ownership of Life Insurance Corporation of India and Government of India. It was established in 1964 as Industrial Development Bank of India, a development finance institution, which provided financial services to industrial sector.

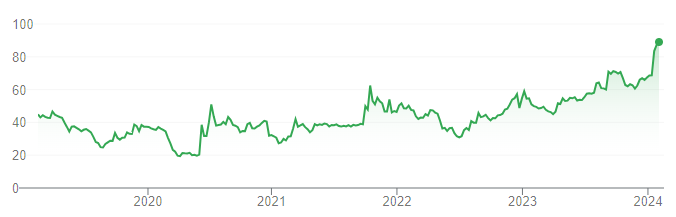

The Current Status of IDBI Bank Share Price

IDBI Bank has been trading in the price range of 94.51 & 86.80. IDBI Bank has given 36.87% in this year & 5.85% in the last 5 days.

Result Highlights : IDBI Bank

Q3FY24 Quarterly Result Announced for IDBI Bank Ltd.

| Indicator | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 |

|---|---|---|---|---|

| Oper Rev Qtr Cr | 6,541 | 6,035 | 6,860 | 5,726 |

| Operating Expenses Qtr Cr | 2,081 | 1,884 | 1,831 | 2,142 |

| Operating Profit Qtr Cr | 2,327 | 2,072 | 3,019 | 2,425 |

| Depreciation Qtr Cr | 0 | 0 | 0 | 0 |

| Interest Qtr Cr | 3,106 | 2,968 | 2,862 | 2,447 |

| Tax Qtr Cr | 549 | 976 | 604 | 308 |

| Net Profit Qtr Cr | 1,458 | 1,323 | 1,224 | 1,133 |

IDBI Share Financials

| P/E Ratio | 17.9 |

| PEG Ratio | 0.3 |

| Market Cap Cr | 95,643 |

| Price to Book Ratio | 2.5 |

| EPS | 3.4 |

| Dividend | 1.1 |

| Relative Strength Index | 65.79 |

| Money Flow Index | 84.23 |

| MACD Signal | 5.58 |

| Average True Range | 4.93 |

Factors Influencing IDBI Bank Share Price

Understanding these factors is crucial for investors and stakeholders who wish to comprehend the dynamics of IDBI Bank’s share price. Here are some key factors influencing IDBI Bank’s share price:

- Macroeconomic Indicators: GDP growth, inflation rates, and interest rates impact the bank’s performance.

- Regulatory Environment: Government policies and regulatory compliance affect operations and investor confidence.

- Financial Performance: Earnings reports, capital adequacy, and asset quality metrics influence investor sentiment.

- Industry Trends: Competitive landscape and technological innovations shape market position and perception.

- Market Sentiment and Investor Behavior: Market volatility, investor confidence, and news affect share price movements.

- Global and Geopolitical Events: Global economic trends and currency fluctuations impact the bank’s performance and investor sentiment.

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

Future Outlook and Investment Implications

The future outlook and investment implications of IDBI Bank shares are influenced by several factors such as Restructuring Efforts, Government Stake, Asset Quality Improvement. However we have concluded some of the factors which will help you to track IDBI share price.

Pros and Cons analysis of IDBI Share –

Pros:

- The IDBI Bank is expected to give good quarter

- IDBI Bank has delivered good profit growth of 19.4% CAGR over last 5 years

- Bank’s working capital requirements have reduced from 178 days to 14.2 days

Cons:

- The bank has a low return on equity of 6.42% over last 3 years, also the contingent liabilities of Rs.1,88,240 Cr..

IDBI bank competitors

IDBI Bank faces competition from several key players in the Indian banking sector:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Punjab National Bank (PNB)

- Bank of Baroda (BoB)

- Kotak Mahindra Bank

These banks compete with IDBI Bank across various segments including retail banking, corporate banking, and digital services. The competition underscores the dynamic nature of the banking industry in India.

Future Target of IDBI Share Price

Although, Investors should conduct thorough research, assess risk factors, and consult with financial advisors before making investment decisions. By understanding the fundamentals and monitoring market developments.

Still on the basis of financial analysis and past track of the resistance levels we have estimated the IDBI Share Price in near future.

| IDBI Share First Target Prediction | 93.40 |

| IDBI Share Second Target Prediction | 97.85 |

| IDBI Share Third Target Prediction | 101.20 |

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator