10 High Dividend Stocks Below 500 Rs. To Invest In 2024

Best Highest Dividend Paying Stocks Under 500 Rs. To Invest In 2024

High Dividend Stocks: Investors seeking to capitalize on dividend income often look for stable companies with consistent payouts. Dividend stocks can be an excellent addition to an investment portfolio, offering both income and potential for growth. In 2024, even with the ever-evolving market dynamics, there are opportunities for investors to find high dividend-yielding stocks, even at prices below 500 Rs. Here are 10 such stocks worth considering for dividend investors.

What is a Dividend?

A dividend is a portion of a company’s profits that it distributes to its shareholders as a reward for investing in the company.

When a company earns profits, it can choose to reinvest those profits back into the business for growth or distribute them to shareholders as dividends.

Dividends are typically paid out regularly, either quarterly, semi-annually, or annually, depending on the company’s policy.

Shareholders receive dividends in proportion to the number of shares they own.

Dividends provide investors with a steady stream of income and are one of the ways shareholders can benefit from owning stock in a company.

10 High Dividend Stocks Below 500 Rs. To Invest In 2024

1. NLC India Ltd (NLCINDIA):

- Sector: Energy

- NLC India, a Navratna public sector enterprise, operates in the lignite mining and power generation sectors. It has a history of consistent dividend payments and offers a dividend yield that is attractive for income-oriented investors.

NLC India Ltd (NLCINDIA) Dividend History

| Announcement Date | Record Date | Ex-Dividend | Dividend Value | Description |

|---|---|---|---|---|

| 06-Feb-24 | 16-Feb-24 | 16-Feb-24 | 1.5 | Rs.1.5000 per share(15%)Interim Dividend |

| 19-May-23 | – | 18-Sep-23 | 2 | Rs.2.0000 per share(20%)Final Dividend |

| 13-Feb-23 | 24-Feb-23 | 24-Feb-23 | 1.5 | Rs.1.5000 per share(15%)Interim Dividend |

| 30-May-22 | – | 21-Sep-22 | 1.5 | Rs.1.5000 per share(15%)Final Dividend |

2. Power Finance Corporation Ltd (PFC): High Dividend Stocks

- Sector: Finance

- PFC is a leading non-banking financial corporation in India that focuses on the power sector. With its stable business model and government backing, PFC regularly distributes dividends to its shareholders, making it an appealing choice for dividend investors.

PFC Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 08-02-2024 | 20-02-2024 | Interim | 35 | 3.50 | Rs.3.5000 per share(35%)Interim Dividend |

| 08-11-2023 | 24-11-2023 | Interim | 45 | 4.50 | Rs.4.5000 per share(45%)Interim Dividend |

| 29-05-2023 | 16-06-2023 | Final | 45 | 4.50 | Rs.4.5000 per share(45%)Final Dividend |

| 13-02-2023 | 24-02-2023 | Interim | 35 | 3.50 | Rs.3.5000 per share (35%) Third Interim Dividend |

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

3. NHPC Ltd (NHPC): High Dividend Stocks

- Sector: Renewable Energy

- NHPC is a premier hydropower generation company in India. Its consistent performance and focus on renewable energy make it an attractive dividend stock. NHPC has a track record of offering dividends, making it an appealing choice for income investors.

NHPC Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 12-02-2024 | 22-02-2024 | Interim | 14 | 1.40 | Rs.1.4000 per share(14%)Interim Dividend |

| 29-05-2023 | 22-08-2023 | Final | 4.5 | 0.45 | Rs.0.4500 per share(4.5%)Final Dividend |

| 07-02-2023 | 17-02-2023 | Interim | 14 | 1.40 | Rs.1.4000 per share(14%) Interim Dividend |

4. Steel Authority of India Ltd (SAIL):

- Sector: Manufacturing

- SAIL is one of India’s largest steel-producing companies. Despite being in a cyclical industry, SAIL has managed to provide consistent dividend payments to its shareholders, making it an interesting option for dividend-focused investors.

SAIL Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 05-02-2024 | 20-02-2024 | Interim | 10 | 1.00 | Rs.1.0000 per share(10%)Interim Dividend |

| 26-05-2023 | 20-09-2023 | Final | 5 | 0.50 | Rs.0.5000 per share(5%)Final Dividend |

| 10-03-2023 | 24-03-2023 | Interim | 10 | 1.00 | Rs.1.0000 per share(10%)Interim Dividend |

5. Bank of Baroda (BOB): High Dividend Stocks

- Sector: Banking

- Bank of Baroda is one of India’s leading public sector banks. Despite challenges in the banking sector, BOB has a history of providing dividends to its shareholders. With its efforts towards improving profitability, BOB remains an attractive dividend stock.

Bank of Baroda (BOB) Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 16-05-2023 | 30-06-2023 | Final | 275 | 5.50 | Rs.5.5000 per share(275%)Dividend |

| 13-05-2022 | 17-06-2022 | Final | 142.5 | 2.85 | Rs.2.8500 per share (142.50%) Revised Dividend |

6. Indian Oil Corporation Ltd (IOC):

- Sector: Oil and Gas

- Indian Oil Corporation is India’s largest oil company. Despite being in a volatile industry, IOC has managed to provide consistent dividends to its shareholders due to its diversified operations and strong market presence.

Indian Oil Corporation Ltd (IOC) Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 31-10-2023 | 10-11-2023 | Interim | 50 | 5.00 | Rs.5.0000 per share(50%)Interim Dividend |

| 16-05-2023 | 28-07-2023 | Final | 30 | 3.00 | Rs.3.0000 per share(30%)Final Dividend |

7. Shipping Corporation of India Ltd (SCI): High Dividend Stocks

- Sector: Shipping

- SCI is the largest Indian shipping company. Despite challenges in the shipping industry, SCI has maintained a track record of dividend payments, making it an interesting choice for income-oriented investors.

Shipping Corporation of India Ltd (SCI) Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 09-05-2023 | 01-09-2023 | Final | 4.4 | 0.44 | Rs.0.4400 per share(4.4%)Dividend |

| 06-05-2022 | 22-09-2022 | Final | 3.3 | 0.33 | Rs.0.3300 per share(3.3%)Dividend |

8. REC Ltd (RECLTD):

- Sector: Infrastructure Finance

- REC is a leading infrastructure finance company in India. With its focus on financing power projects, REC has managed to provide consistent dividends to its shareholders, making it an attractive option for dividend investors.

REC Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 01-11-2023 | 13-11-2023 | Interim | 35 | 3.50 | Rs.3.5000 per share(35%)Second Interim Dividend |

| 26-07-2023 | 14-08-2023 | Interim | 30 | 3.00 | Rs.3.0000 per share(30%)Interim Dividend |

| 26-06-2023 | 14-07-2023 | Final | 43.5 | 4.35 | Rs.4.3500 per share(43.5%)Final Dividend |

| 30-01-2023 | 09-02-2023 | Interim | 32.5 | 3.25 | Rs.3.2500 per share (32.50%) Second Interim Dividend |

9. ITC Ltd (ITC):

- Sector: Diversified

- ITC is one of India’s leading diversified conglomerates with businesses spanning across FMCG, Hotels, Paperboards & Packaging, and Agri-Business. Despite challenges in some of its segments, ITC has consistently provided dividends to its shareholders, making it an attractive dividend stock.

ITC Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 29-01-2024 | 08-02-2024 | Interim | 625 | 6.25 | Rs.6.2500 per share(625%)Interim Dividend |

| 18-05-2023 | 30-05-2023 | Final | 675 | 6.75 | Rs.6.7500 per share(675%)Final Dividend |

| 19-05-2023 | 30-05-2023 | Special | 275 | 2.75 | Rs.2.7500 per share(275%)Special Dividend |

| 03-02-2023 | 15-02-2023 | Interim | 600 | 6.00 | Rs.6.0000 per share(600%)Interim Dividend |

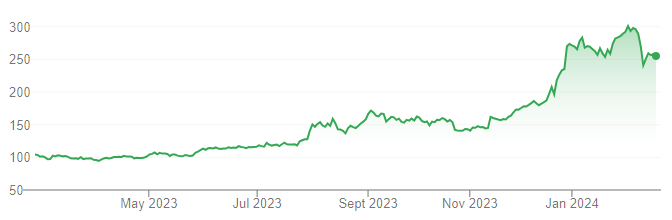

10. Hindustan Copper Ltd. Share Price Chart

- Sector: Mining

- Hindustan Copper is a vertically integrated copper producer in India. With the increasing demand for copper, Hindustan Copper is well-positioned to benefit, and its dividend payments make it an interesting choice for income-focused investors.

Hindustan Copper Dividend History

| Announcement Date | Ex-Date | Dividend Type | Dividend (%) | Dividend (Rs) | Remarks |

|---|---|---|---|---|---|

| 19-05-2023 | 22-09-2023 | Final | 18.4 | 0.92 | Rs.0.9200 per share(18.4%)Final Dividend |

| 30-05-2022 | 20-09-2022 | Final | 23.2 | 1.16 | Rs.1.1600 per share(23.2%)Final Dividend |

Why Invest in the Highest Dividend Paying Stocks?

Investing in the highest dividend-paying stocks offers investors a reliable source of income.

These stocks consistently distribute a portion of their profits to shareholders in the form of dividends.

By choosing such stocks, investors can enjoy regular cash payments without having to sell their shares.

This passive income stream can be especially valuable for retirees or those seeking financial stability.

Additionally, high dividend-paying stocks often belong to well-established companies with strong financial performance, providing a level of security and confidence to investors.

Overall, investing in the highest dividend-paying stocks can be a prudent strategy for building wealth and achieving financial goals.

In conclusion, these 10 high dividend stocks below 500 Rs. offer investors the opportunity to generate income while potentially benefiting from capital appreciation in the long run. However, investors should exercise caution and perform their due diligence before making any investment decisions.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator