Gift Nifty Live: Gift (SGX) Nifty Index Info

Track Gift Nifty, Current Price of GIFT Nifty, GIFT Nifty F&O contracts

Gift Nifty Live: Welcome to the dynamic world of investing, where opportunities abound and strategies evolve. In recent times, the Indian financial landscape has witnessed the emergence of innovative investment vehicles, one of which is the GIFT NIFTY. Designed to cater to the modern investor’s needs, GIFT NIFTY offers a unique avenue for exploring the Indian stock market. Let’s delve deeper into what GIFT NIFTY is all about and how it can be a game-changer for your investment portfolio.

Understanding GIFT NIFTY

GIFT NIFTY is short form Gujarat International Finance Tec-City National Stock Exchange Fifty Index. It represents the top 50 companies listed on the National Stock Exchange (NSE) of India. These companies are handpicked based on various parameters. Some of the parameters are market capitalization, liquidity, and trading frequency. As a benchmark index, GIFT NIFTY serves as a barometer for the overall performance of the Indian stock market, reflecting the sentiment and trends prevalent in the economy. It was founded on 03 July 2021. Its Official website is www.nseix.com.

Why Consider GIFT NIFTY?

- Diversification: GIFT NIFTY offers investors exposure to a diversified portfolio of leading Indian companies across different sectors. By investing in GIFT NIFTY, investors can spread their risk and mitigate the impact of adverse market movements affecting specific sectors or companies.

- Growth Potential: The constituents of GIFT NIFTY are industry leaders with strong fundamentals and growth prospects. Investing in GIFT NIFTY allows investors to capitalize on the growth potential of India’s vibrant economy.

- Transparency and Liquidity: GIFT NIFTY is a transparent and liquid index, ensuring fair price discovery and seamless trading. With a wide range of financial products such as index funds, exchange-traded funds (ETFs), and futures and options contracts based on GIFT NIFTY, investors have ample liquidity and flexibility to execute their investment strategies.

- Benchmark for Performance Evaluation: For fund managers, institutional investors, and individual traders, GIFT NIFTY serves as a benchmark for evaluating the performance of their investment portfolios. By comparing their returns against the performance of GIFT NIFTY, investors can assess their investment strategies and make informed decisions to optimize their returns.

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

Fundamentals of GIFT NIFTY:

GIFT NIFTY, short for Gujarat International Finance Tec-City National Stock Exchange Fifty, represents a unique facet of India’s financial ecosystem. To grasp its fundamentals, it’s essential to understand its composition, purpose, and significance within the broader financial landscape:

GIFT NIFTY Composition:

- GIFT NIFTY comprises a selection of stocks listed on the National Stock Exchange (NSE) that are also traded on the Gujarat International Finance Tec-City (GIFT City) platform.

- The index is meticulously curated to include high-quality, liquid stocks that reflect the performance of companies listed on both NSE and GIFT City

Methodology Of GIFT NIFTY

- The methodology for selecting constituents and calculating the index value adheres to rigorous standards to ensure accuracy, transparency, and representativeness.

- Constituent stocks are chosen based on predefined criteria. Which includes market capitalization, liquidity, and trading volume, to reflect the performance of the underlying companies effectively.

- Various factors determine weightage assigned to each constituent stock. These factor are market capitalization and trading activity, with periodic rebalancing to maintain index integrity.

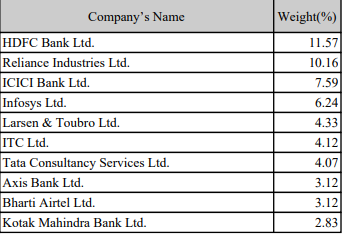

NIFTY 50 Weighted Average of Stocks

Top constituents by weightage

What are the different Gift Nifty contracts?

GIFT NIFTY is dollar denominated products and that are available in following indices

- GIFT Nifty 50: This is the most popular Gift Nifty contract, and it tracks the Nifty 50 index.

- GIFT Nifty Bank: This contract tracks the Nifty Bank index, which consists of the 12 largest banks in India

- GIFT Nifty Financial Services: This contract tracks the Nifty Financial Services index, which consists of the 25 largest financial services companies in India.

- GIFT Nifty IT: This contract tracks the Nifty IT index, which consists of the 25 largest IT companies in India.

Gift Nifty One year Performance:

- 52 week High : 22,205

- 52 week Low : 16818.8

Key Features Gift Nifty

- Risk Mitigation: Gift Nifty is structured to minimize risks associated with market volatility. With a guaranteed component, investors can enjoy a level of security not typically found in other market-linked investments.

- Market Exposure: Gift Nifty allows investors to participate in the performance of the Nifty index, which comprises 50 well-established companies. This exposure to diverse sectors provides a balanced investment opportunity.

- Guaranteed Returns: One of the standout features of Gift Nifty is the assurance of returns, irrespective of market fluctuations. This makes it an attractive option for those seeking stable growth over the long term.

- Flexibility: Investors can choose from various tenure options, allowing them to tailor their investment horizon according to their financial goals. This flexibility is especially beneficial for individuals with specific timeframes in mind.

How to Invest in Gift Nifty Live:

Investing in GIFT NIFTY is relatively straightforward. Once can do it through various channels:

- Index Funds: Investors can opt for index funds that replicate the performance of GIFT NIFTY. These funds invest in the same constituents of the index in the same proportion, offering investors a hassle-free way to gain exposure to the index.

- Exchange-Traded Funds (ETFs): ETFs tracking GIFT NIFTY are traded on stock exchanges. It is providing investors with the flexibility to buy and sell units throughout the trading day at prevailing market prices. ETFs offer cost-effective and efficient access to GIFT NIFTY for both retail and institutional investors.

- Futures and Options Contracts: For traders seeking to capitalize on short-term price movements in GIFT NIFTY, futures and options contracts provide a leveraged trading opportunity. However, it’s essential to understand the risks associated with derivatives trading and have a sound risk management strategy in place.

How can I trade Gift Nifty Live?

Presently, only NRIs can trade Gift Nifty through a broker that is a member of the NSE IX. You will need to open trading account with the broker and deposit funds before you can start trading.

GIFT NIFTY ETF

GIFT NIFTY ETF (Exchange-Traded Fund) offers investors an opportunity to gain exposure to the performance of the GIFT NIFTY index. It reflects the dynamics of stocks traded within the Gujarat International Finance Tec-City (GIFT City) platform. As an ETF, various factors, including market conditions, sectoral trends, and the overall economic landscape influence its price and future prospects.

The price of the GIFT NIFTY ETF is directly correlated with the performance of the underlying stocks comprising the GIFT NIFTY index.

Gift Nifty Live Trading Hours

GIFT Nifty operates in two trading sessions.

- The first session runs from 4:30 am to 2:00 pm IST

- The second session is from 3:30 pm to 11:30 pm IST. This extended trading window aims to align with international market timings

Conclusion:

In conclusion, GIFT NIFTY presents a compelling investment opportunity for investors seeking exposure to the Indian equity market. With its diversified portfolio, growth potential, and liquidity, GIFT NIFTY is poised to play a significant role in shaping the investment landscape in India. By understanding the fundamentals of GIFT NIFTY and adopting a disciplined approach to investing, investors can harness its potential to achieve their financial goals and create wealth over the long term.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator