Gautam Adani Companies and Their Share Market Performance

Investing in Adani Group: Performance and Prospects

Gautam Adani Shares: The Adani Group, founded by Gautam Adani in 1988, has emerged as a global conglomerate with diverse business interests. Initially starting as a trading firm, it swiftly expanded into sectors such as ports, logistics, power, and infrastructure. Today, the group is a key player in India’s economic landscape, with a formidable presence in energy, transportation, and agribusiness. Adani Ports and Special Economic Zone (APSEZ) is one of the largest port operators in India, and Adani Power is a major player in the energy sector. Their ventures extend internationally, making Adani Group a pivotal force in both Indian and global markets.

Adani Group Companies

Adani Group encompasses a wide range of companies, each playing a significant role in the Indian economy:

- Adani Ports and Special Economic Zone (APSEZ):

- Sector: Infrastructure and Ports

- Major Projects: Manages and operates a network of ports and terminals, including Mundra, India’s largest commercial port, and numerous Special Economic Zones (SEZs).

- Role: Vital for facilitating India’s import-export trade, enhancing logistics, and driving economic growth.

2. Adani Power:

- Sector: Energy

- Major Projects: Operates thermal and renewable power plants across India, contributing to the country’s energy generation.

- Role: Contributes significantly to India’s energy security and supports the growing power needs of the nation.

3. Adani Green Energy:

- Sector: Renewable Energy

- Major Projects: A leading player in renewable energy generation with a focus on solar and wind power.

- Role: Promotes clean energy and aligns with India’s sustainable development goals.

4. Adani Enterprises:

- Sector: Diverse – including trading, power, infrastructure, and resources.

- Major Projects: Engaged in various ventures, from coal mining to city gas distribution.

- Role: A multifaceted conglomerate contributing to India’s economic development through its diverse business interests.

5. Adani Transmission:

- Sector: Energy Transmission

- Major Projects: Manages electricity transmission networks across India.

- Role: Facilitates efficient power distribution and contributes to the stability of the country’s electrical grid.

6. Adani Green Energy Limited:

- Sector: Renewable Energy

- Major Projects: Focuses on developing and operating solar and wind power projects.

- Role: Pioneering clean and sustainable energy solutions in India.

7. Adani Gas:

- Sector: City Gas Distribution

- Major Projects: Expanding the distribution of natural gas for various domestic, commercial, and industrial applications.

- Role: Supports the transition to cleaner and more sustainable energy sources.

Adani Group’s diversified presence in these sectors has had a transformative impact on the Indian economy, contributing to infrastructure development, job creation, and energy security, while also aligning with India’s sustainable and renewable energy goals.

Gautam Adani Companies’ Share Market Performance

The Adani Group companies have seen a mix of historical performance in the share market. Please note that the information is based on data available up to that point, and the stock market can be highly dynamic and subject to change.

Click to Open Free UpStox Demat account/ Trading Account

Click to Open Free Sharekhan Demat Account / Trading Account

1. Adani Ports and Special Economic Zone (APSEZ):

- APSEZ has shown remarkable growth over the years. It is one of the largest port operators in India and has benefited from India’s increasing trade and infrastructure development. Its stock price and market capitalization have steadily risen due to its strategic location and expansion of port facilities.

Adani Ports and Special Economic Zone (APSEZ) Share price and financial Analysis

2. Adani Power:

- Adani Power, which operates thermal and renewable power plants, faced challenges due to regulatory issues and the shift towards clean energy. The stock’s performance was somewhat volatile, influenced by factors like changes in coal prices and power tariffs.

Adani Power Share price and financial Analysis

3. Adani Green Energy:

- Adani Green Energy, focused on renewable energy, witnessed significant growth as India embraced clean energy solutions. Its stock price and market capitalization surged with the global emphasis on sustainability and renewable energy projects.

Adani Green Energy Share price and financial Analysis

4. Adani Enterprises:

- Adani Enterprises is a diversified entity, and its stock performance depended on various sectors, including coal mining, agribusiness, and defense. The acquisition of the Mumbai International Airport marked a notable milestone in its diversification strategy.

Adani Enterprises Share price and financial Analysis

Notable milestones for the Adani Group companies also include securing key contracts, such as the development of the Mundra Port, the expansion into solar and wind power generation, and their successful bid for the acquisition of several airports in India. These milestones have contributed to their growth and market presence.

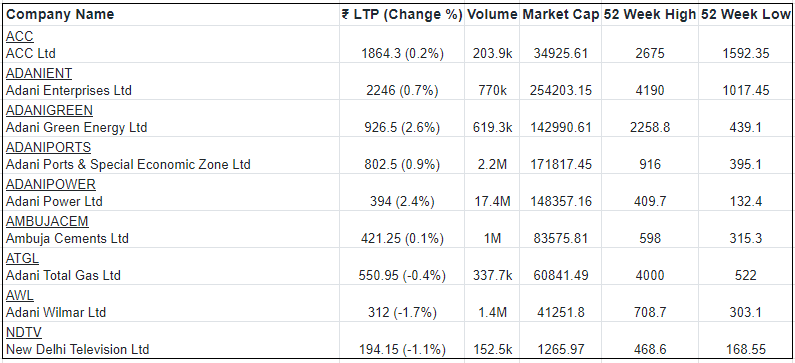

Below is the list of Top Adani Companies With Share Prices.

Factors Influencing Adani Shares’ Prices

Several factors can significantly impact the stock prices of Adani Group companies. Here are some key ones:

Government Policies and Regulations:

- Energy and Environmental Policies: For Adani Green Energy and Adani Power, government policies related to renewable energy targets, carbon emissions, and subsidies can have a substantial impact on their stock prices.

- Infrastructure and Port Policies: For Adani Ports and Special Economic Zone, government policies related to port development, ease of doing business, and trade facilitation can influence stock prices.

Global Economic Trends:

- Commodity Prices: Adani Group’s performance, particularly in sectors like power and mining, can be influenced by global commodity prices, such as coal and natural gas.

- Global Trade and Logistics: Adani Ports and Special Economic Zone’s performance can be affected by global trade trends, shipping volumes, and international trade agreements.

Industry-Specific Factors:

- Renewable Energy Trends: For Adani Green Energy, global and national trends in renewable energy adoption, technological advancements, and government incentives play a crucial role.

- Power Demand and Supply: For Adani Power, factors affecting electricity demand, supply dynamics, and pricing in the energy market are significant.

- Infrastructure Development: The overall pace and scale of infrastructure development projects, including ports, airports, and other facilities, directly impact Adani Enterprises and Adani Ports.

Financial Performance and Debt Levels:

- The financial health of Adani Group companies, including their revenue, profit margins, and debt levels, can influence investor sentiment and stock prices.

Geopolitical Events and Geographical Considerations:

- Events like geopolitical tensions, changes in trade policies, or natural disasters can affect the operations and profitability of Adani Group companies.

Market Sentiment and Investor Behavior:

- Market sentiment, influenced by factors like news, rumors, and investor perceptions, can lead to short-term fluctuations in stock prices.

Technological Advancements:

- In sectors like renewable energy, technological advancements and breakthroughs can have a profound impact on competitiveness and profitability.

Environmental and Social Considerations:

- Adani Group’s adherence to environmental and social standards, as well as any controversies or compliance issues, can affect investor confidence.

It’s important to note that these factors can interact in complex ways, and their impact may vary depending on the specific circumstances and timeframes. Investors interested in Adani Group companies should conduct thorough research and consider consulting financial advisors to make informed decisions. Additionally, staying updated with current news and industry trends is crucial for understanding the evolving factors affecting the stock prices of these companies.

Gautam Adani Shares Investment Opportunities

Investing in the Adani Group offers diverse opportunities across sectors like ports, power, renewable energy, infrastructure, and more.

- For conservative investors seeking stability, Adani Ports and Special Economic Zone (APSEZ) offers a stronghold in India’s vital logistics and trade industry.

- Adani Green Energy, a leader in renewable power generation, aligns with global sustainability goals and presents potential for substantial growth.

- Adani Power, while subject to regulatory shifts, can be a part of a balanced portfolio given India’s growing energy demand.

- Adani Enterprises, with interests in diverse sectors, provides exposure to various industries.

Strategies for entering the market can vary. Long-term investors may focus on companies like Adani Green Energy, positioned well in the renewable energy sector. Traders may track short-term market trends for companies like APSEZ.

Diversifying investments across multiple Adani companies can spread risk. However, it’s crucial to conduct thorough research, monitor market trends, and consider consulting financial advisors before making investment decisions.

Additionally, staying informed about industry dynamics and macroeconomic factors is essential for successful investment in the Adani Group.

Gautam Adani Shares Future Prospects

The Adani Group continues to focus on growth and expansion.

- Adani Ports aims to develop new ports and logistics hubs, solidifying its position as a key player in India’s trade ecosystem.

- Adani Green Energy is set to expand its renewable energy capacity, contributing to India’s green energy goals and potentially becoming a global leader.

- Adani Power plans to diversify into cleaner energy sources, aligning with global sustainability trends.

- Adani Enterprises explores new sectors, such as airport management, strengthening their diversified portfolio.

These initiatives underline their role in shaping India’s infrastructure landscape and advancing environmental sustainability, potentially impacting global markets in renewable energy and logistics.

Risks and Challenges : Gautam Adani’s Companies.

Investors considering Adani Group companies should be mindful of several potential risks. Regulatory changes, especially in the energy sector, can impact profitability. Environmental and social controversies may lead to reputational damage. Geopolitical tensions or trade disputes can affect operations and market access.

Additionally, as Adani Group operates in diverse sectors, each may face unique challenges, such as fluctuations in commodity prices for Adani Power or port congestion for Adani Ports. Moreover, the conglomerate’s heavy reliance on debt for expansion could be a financial risk if not managed prudently. Thorough due diligence and continuous monitoring of market dynamics are essential for informed investment decisions.

Conclusion

In conclusion, Adani Group companies have shown mixed historical performance, with some excelling due to India’s growth and global sustainability goals. Investors should be aware of risks like regulatory changes and environmental issues while considering investments in Adani Group companies. The group’s diversified portfolio continues to impact India’s economy and contribute to various sectors, providing potential opportunities for investors with a well-informed approach.

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator