Top 10 Best Stocks To Invest In 2024 Under 100 Rs.

Undervalued shares, buy multi bagger stocks below Rs. 100, Top 10 Stocks to buy for short term

Best Stocks Under 100 2024 – Most of the investors do not have big pockets to invest in stock market which restricts them to invest in large cap shares in India. There are some best multi bagger penny stocks to invest which can be a solution to those people. It is a reality that many investors buy shares which are overvalued due to hype created by media and news websites.

Recently we have seen the upward trend in Stock Market in India even when the global technology stocks are not performing well. There was a steep growth in stocks in the real estate, metal and energy sectors. If we talk about Top Gainers Shares, Eicher Motors, Adani Enterprises and Bharat Petroleum Corporation, ICICI Bank were among the Top Gainers Stocks in 2024. And if we talk about NSE top losers shares 2024 Power Grid Corporation, Zee Entertainment and UPL were among the Top Losers stocks in India.

Though, everybody should invest in shares after deep research about the company and statistics. But, there are some stocks which are presently trading at low price even after having strong financials and reputation due to less investors or coverage in media.

Read Also | 6 things you Must know before market opens

Open bank account with no minimum balance requirement

Here in this article we will see about top 10 stocks to invest in 2024 under 100 Rs. which are undervalued and can perform well in the short term.

Click to Open Free UpStox Demat account/ Trading Account

Click to Open Free Sharekhan Demat Account / Trading Account

Why to buy undervalued stocks in India 2024?

There are numerous reasons why you should invest in top 10 stocks below Rs. 100. which you can read below –

- You should invest in best Undervalued stocks in 2024 as these may attain their intrinsic value which will fetch you good return in the short term.

- Comparatively less prices to buy good stocks with good financials and high reputation of well-established companies.

- High investment volume may help these stocks to outperform in less time.

- Low risk high return shares to invest.

List of top 10 Best stocks to buy under Rs 100 2024

1. IRFC, Best Stocks Under 100

Indian Railway Finance Corporation is an Indian public sector undertaking engaged in raising financial resources for expansion and running through capital markets and other borrowings. The Government of India owns a majority stake in the company, while the Ministry of Railways has the administrative control.

As per the Railway Ministry, by FY26, India plans to export standard-gauge Vande Bharat trains. The plan, if realised, will place India on par with eight countries that have the capability to manufacture trains with speeds of 180 kmph or more.

IRFC’s strong balance sheet size with nil gross NPA, low overheads, and the Indian Railways’ huge capex needs bode well for the company’s growth prospects over the long term.

You may invest in this share at the level of Rs. 65-68 with a target of Rs. 92-93 per share.

Explained : Improve Credit Score, How improved CIBIL help

National Stock Exchange of India (NSE), Stocks listed on Nifty

Bombay Stock Exchange (BSE), Stocks listed on Sensex

2. Indian Oil Corporation, Best Stocks Under 100 2024

Indian Oil Corporation Limited is an Indian oil and gas company under the ownership of the Ministry of Petroleum and Natural Gas, Government of India. It is headquartered in New Delhi. It is a public sector undertaking whose operations are overseen by the Ministry of Petroleum and Natural Gas

The Research and Development Branch, Pipelines Branch, Petrochemicals Branch, Explosive Branch, Refineries Branch, and Production Branch are the seven main business divisions that make up the oil company. Indian Oil owns more than 50% market share for petroleum products.

The business involves exploration, production, refining, pipeline transportation, and natural gas and petroleum products marketing. The company established subsidiaries in the United States, the Netherlands, Sweden, Mauritius, the UAE, and Sri Lanka.

The present price of the share is ranging between 95-98 Rs. per share. The P/E ratio of the share is 4.19 and dividend yield is above 5%. You may invest in this share at the level of Rs. 86-90 with a target of Rs. 118-126 per share.

3. Steel Authority of India, Best Stocks Under 100 2024

Steel Authority of India Limited is a central public sector undertaking based in New Delhi, India. It is under the ownership of the Ministry of Steel, Government of India with an annual turnover of ₹105,398 crore for the fiscal year 2022-23. Incorporated on 24 January 1973, SAIL has 59,350 employees.

The present price of the share is ranging between 93-95 Rs. per share. The P/E ratio of the share is above 12. You may invest in this share at the level of Rs. 75 – 80 with a target of Rs. 110-120 per share.

Click Here to get personalized help on how much to invest in share market for beginners

How do they decide Stocks Upper Circuit limit

Financial Planning for your child’s Education

4. HFCL, Best Stocks Under 100 2024

HFCL Limited is an Indian technology company, based in Gurugram. It designs, develops, manufactures telecommunications equipment, fibre-optic cables and other related electronics. The company is listed on both the Bombay Stock Exchange and on the National Stock Exchange.

The present price of the share is ranging between 60-62 Rs. per share. The P/E ratio of the share is above 30. You may invest in this share at the level of Rs. 58-59 with a target of Rs. 72-73 per share.

5. Bhansali Engg Polymers, Best Stocks Under 100 2024

The company is engaged in manufacturing ABS resins, AES resins, ASA resins, SAN resins, and their alloys with other plastics. Its products are used in home appliances, automobiles, electronics, healthcare and kitchenware. The company has two manufacturing facilities with a total capacity of 137 thousand tonnes per annum.

It is planning to increase its capacity further to 200,000 tonnes per annum by December 2024 with an investment of Rs 5 billion (bn), which it plans to fund entirely through internal resources to retain its debt-free status.

Bhansali Engineering Polymers also has an in-house state-of-the-art research and development (R&D) facility where it is developing some important raw materials which it primarily imports from abroad.

The present price of the share is ranging between 89-90 Rs. per share. The P/E ratio of the share is abive 16. You may invest in this share at the level of Rs. 86 – 87 with a target of Rs. 122-128 per share.

Get personalized help on investment in current IPOs.

How ASM Framework restricted 20 stocks including Adani Wilmar to get more investors?

Muhurat Trading: Know Everything in detail, Timing, Tips

6. Indian Renewable Energy Dev Agency Ltd, Best Stocks Under 100 2024

Indian Renewable Energy Development Agency Limited is formed in 1987 as a Mini Ratna Government of India Enterprise under Government of India and administratively controlled by the Ministry of New and Renewable Energy.

The present price of the share is ranging between 62 Rs. per share. The P/E ratio of the share is above 13. You may invest in this share at the level of Rs. 59-60 with a target of Rs. 96-98 per share.

7. Rail Vikas Nigam Ltd

Rail Vikas Nigam Limited is a Category-I Mini-Ratna CPSE under the Ministry of Railways. It was incorporated in 2003 to meet the country’s surging infrastructural requirements and to implement projects on a fast-track basis.

The present price of the share is ranging between 65 – 66 Rs. per share. The P/E ratio of the share is 10.41. You may invest in this share at the level of Rs. 63 – 64 with a target of Rs. 78 – 80 per share.

Read this: The Complete Penny Stock Course: Learn How to Generate Profits Consistently by Trading Penny Stocks

8. CESC –

The Calcutta Electric Supply Corporation is the Kolkata-based flagship company of the RP-Sanjiv Goenka Group, born from the erstwhile RPG Group, under the chairmanship of businessman Sanjiv Goenka.

The present price of the share is ranging between 96-98 Rs. per share. The P/E ratio of the share is abive 11. You may invest in this share at the level of Rs. 89-90 with a target of Rs. 125-130 per share.

9. NATIONALUM

National Aluminium Company Limited is a government company having integrated and diversified operations in mining, metal and power under the ownership of the Ministry of Mines and Government of India. Presently, the Government of India holds a 51.5% equity in NALCO.

The present price of the share is ranging between 96 Rs. per share. The P/E ratio of the share is above 14. You may invest in this share at the level of Rs. 85-87 with a target of Rs. 112-120 per share.

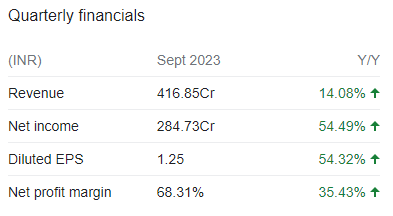

10. Equitas Small Finance Bank Ltd

Equitas Small Finance Bank is a small finance bank founded in 2016 as a microfinance lender. The bank has its headquarters in Chennai, and is a subsidiary of holding company Equitas Holdings Ltd.

The present price of the share is ranging between 94-95 Rs. per share. The P/E ratio of the share is above 14. You may invest in this share at the level of Rs. 85-87 with a target of Rs. 112-118 per share.

Disclaimer:

This blog is for educational purposes. The securities quoted are exemplary and are not recommendatory.

AMAZING DEALS ON AMAZON SALE

Samsung Washing Machine | Nike Air Jordon Shoes | Samsung 4K Television | boAT Home Theatre

Panasonic AC | Gaming Laptops | Mi Smart TV | Best Acer Laptops | Blue Star AC | Gaming Tab

Get personalized help on investment in current IPOs

How ASM Framework restricted 20 stocks including Adani Wilmar to get more investors?

Muhurat Trading: Know Everything in detail, Timing, Tips

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator