Best Share Under 100 Rs. To Buy In March 2024

Stocks which has doubled investment in just 6 months, this march invest in best stocks under 100

Best share under 100: Investing in the stock market can be a rewarding way to grow your wealth over time. While it’s commonly believed that you need a substantial amount of money to invest in stocks. But there are plenty of options available even for those with limited funds.

In March 2024, the Indian stock market continues to offer opportunities for investors, including shares that are priced under 100 rupees. Here are some of the best shares under 100 to consider investing in this month:

1. Suzlon Energy Ltd | Best share under 100

Suzlon Energy Ltd is a prominent player in the renewable energy sector, specializing in wind turbine technology.

As the world shifts towards cleaner and more sustainable energy sources, companies like Suzlon are well-positioned to benefit from this trend.

Despite facing challenges in the past, including debt restructuring and operational issues, Suzlon has been working towards strengthening its financial position and expanding its market presence.

With its shares trading below 100 rupees, Suzlon represents an attractive investment opportunity for those bullish on the renewable energy sector.

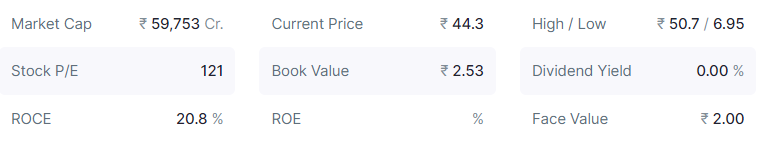

The stock has hit low of Rs. 22 on 13 September 2023 and Suzlon CMP is Rs. 44.25 per Share. However, the share has hit high of Rs. 49.35 on 08 Feb 2024. This stock has doubled the invested money in just 6 months.

Suzlon Financial Data

The stock is expected to touch 64 Rs. levels within few months.

2. National Aluminium Company Ltd (NALCO)

National Aluminium Company Ltd (NALCO) is a leading producer of aluminum and alumina products in India.

The company operates across the entire value chain of aluminum production, from mining bauxite to refining alumina and smelting aluminum.

With increasing demand for aluminum in various industries such as automotive, construction, and packaging, NALCO stands to benefit from favorable market conditions.

Additionally, the government’s focus on infrastructure development and Make in India initiatives could further boost NALCO’s prospects.

Trading at a price below 100 rupees per share, NALCO offers investors an opportunity to gain exposure to the growing aluminum market.

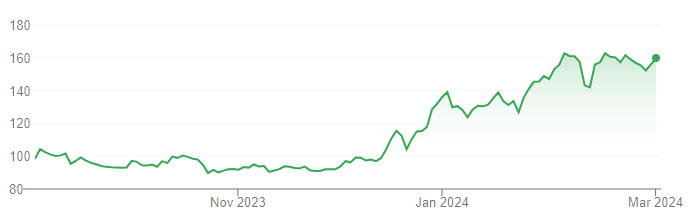

The stock has hit low of Rs. 89.70 on 16 October 2023 and CMP is Rs. 159.65 per Share. However, the share has hit high of Rs. 162.75 on 06 Feb 2024. This stock has almost doubled the invested money in just 6 months.

NALCO Financial Data

The stock is expected to touch 209 Rs. levels within few months.

3. Punjab National Bank (PNB) | Best share under 100

Punjab National Bank (PNB) is one of India’s oldest and largest public sector banks.

Despite facing challenges related to non-performing assets (NPAs) and corporate governance issues in the past, PNB has taken significant steps to strengthen its balance sheet. Also PNB is focusing on improvement of operational efficiency.

With the Indian economy showing signs of recovery and the banking sector poised for growth, PNB could benefit from increased lending activity and improved asset quality.

Priced under 100 rupees per share, PNB presents an attractive investment proposition for those looking to capitalize on the revival of the banking sector.

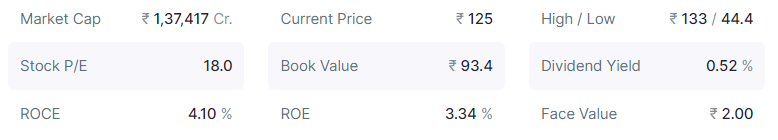

The stock has hit low of Rs. 65.70 on 06 September 2023 and CMP is Rs. 125 per Share. However, the share has hit high of Rs. 130.15 on 16 Feb 2024. This stock has almost doubled the invested money in just 6 months.

PNB Financial Data

The stock is expected to touch 168 Rs. levels within few months.

AMAZING DEALS ON AMAZON SALE

Samsung Washing Machine | Nike Air Jordon Shoes | Samsung 4K Television | boAT Home Theatre

Panasonic AC | Gaming Laptops | Mi Smart TV | Best Acer Laptops | Blue Star AC | Gaming Tab

4. NHPC Limited | Best share under 100

NHPC is a leading hydropower generation company in India.

With an increasing focus on renewable energy sources and a commitment to sustainable practices, NHPC is positioned for growth.

The company’s low stock price provides an affordable entry point for investors interested in the renewable energy sector, which is expected to play a crucial role in India’s future energy landscape.

Company has been maintaining a healthy dividend payout of 49.5%

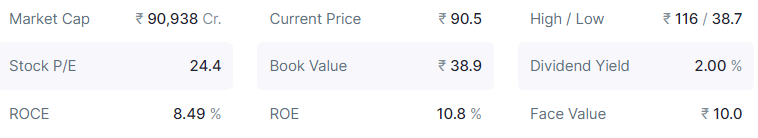

The stock has hit low of Rs. 49.5 on 01 November 2023 and CMP is Rs. 90.55 per Share. However, the share has hit high of Rs. 103.65 on 05 Feb 2024. This stock has almost doubled the invested money in just 6 months.

NHPC Financial Data

The stock is expected to touch 120 Rs. levels within few months.

5. Punjab & Sind Bank | Best share under 100

Punjab & Sind Bank (NSE: PSB) is a notable player in India’s banking sector.

Established in 1908, it has since grown into a prominent government-owned bank, offering a wide range of financial services to retail and commercial clients across the country.

With its headquarters in New Delhi, Punjab & Sind Bank operates through a network of branches and ATMs, providing banking solutions such as deposits, loans, investments, and digital banking services.

Despite facing challenges inherent in the banking industry, Punjab & Sind Bank has demonstrated resilience and adaptability over the years.

With a focus on customer service and technological innovation, the bank continues to expand its reach and enhance its product offerings to meet the evolving needs of its diverse clientele.

Company has delivered good profit growth of 30.4% CAGR over last 5 years

The stock has hit low of Rs. 38 on 23 October 2023 and CMP is Rs. 65 per Share. However, the share has hit high of Rs. 75.15 on 07 Feb 2024. This stock has almost doubled the invested money in just 6 months.

PSB Financial Data

The stock is expected to touch 82 Rs. levels within few months.

Conclusion

Investing in shares priced under 100 rupees can be an attractive option for investors looking to diversify their portfolios and capitalize on emerging opportunities in the Indian stock market.

However, it’s essential to conduct thorough research and analysis before making any investment decisions. While the shares mentioned above present compelling investment opportunities, investors should consider factors such as market trends, industry dynamics, and company fundamentals before investing their hard-earned money.

By staying informed and adopting a disciplined approach to investing, investors can navigate the complexities of the stock market and achieve their long-term financial goals.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator