Top 10 Best Performing Stocks 2024 in India

These are the Top Best 10 performing stocks in NSE, based on 1 year performance

Best Performing Stocks 2024: As the year 2024 unfolds, investors are keenly eyeing opportunities in the stock market to maximize their returns. While high-priced stocks often grab headlines, there is a growing interest in stocks that are not only performing well but also affordable for a wide range of investors.

Investing in stocks priced under ₹100 can be a strategic move for investors looking for affordable entry points into the market. The stocks mentioned below have not only demonstrated impressive performance but also have the potential for further growth. As the market landscape continues to evolve, staying informed and adapting to changing trends will be key to successful investing in 2024. This list is updated frequently.

LEARN MORE || How to invest in stocks

Best Stocks by one- year performance | Top 10 stock ideas for your 2024

1. Greenply Industries | Best Performing Stocks 2024

Greenply Industries is an Indian company that is primarily engaged in the manufacturing of plywood and allied products. The company produces a wide range of products, including plywood, blockboards, decorative laminates, medium-density fiberboards (MDF), flush doors, and adhesives.

The company has been a prominent player in the Indian plywood and allied products market. Greenply Industries has gained recognition for its commitment to quality and innovation in the construction and interior design industry. They cater to both the domestic and international markets.

Why to invest in Greenply Industries?

The real estate sector is expected to boom in upcoming years due to government policies and people spend capacity data available in market. The high demand of building materials like Woodpanel (Ply, Laminates and MDF) will also be at top level . Greenply will be one of the key beneficiaries of the same.

Greenply Industries Limited, is among India’s largest interior infrastructure brands, headquartered in Kolkata, West Bengal.

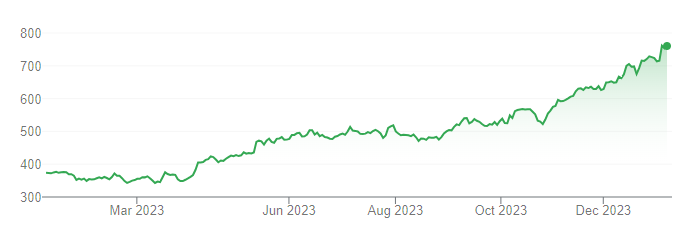

The company’s share has performed very well in last year which can be seen in the below chart.

The stocks has gained more than 76% in last 12 months.

2. Cyient | Best Performing Stocks 2024

Cyient is an Indian multinational company that provides engineering, manufacturing, geospatial, network, and operations management services to various industries. The company was founded in 1991 and is headquartered in Hyderabad, India. Cyient serves clients in industries such as aerospace, defense, telecommunications, utilities, transportation, and healthcare.

Why to invest in Cyient?

The company offers a range of services, including product design and development, engineering solutions, data analytics, and digital transformation services. Cyient has expertise in areas such as engineering, network and operations management, geospatial solutions, and information technology.

It has a global presence with offices and delivery centers in multiple countries, including the United States, Europe, Asia, and Australia. Cyient works with clients worldwide to help them enhance their operational efficiency, innovate in product development, and navigate the challenges of the modern business landscape.

The stocks has gained more than 170% in last 12 months.

3. Wonderla Holidays Ltd | Best Performing Stocks 2024

Wonderla Holidays Ltd is an Indian amusement park and resort chain. The company operates three major amusement parks in India: Wonderla Kochi in Kochi, Wonderla Bengaluru in Bangalore, and Wonderla Hyderabad in Hyderabad. These parks are popular destinations for families and thrill-seekers, offering a variety of rides, water attractions, and entertainment options.

Why to invest in Wonderla Holidays Ltd?

Wonderla Holidays is known for its high-quality amusement park experiences, with a range of rides catering to different age groups and preferences. Some of the attractions in Wonderla parks include roller coasters, water slides, wave pools, and other exciting rides.

Apart from amusement parks, Wonderla Holidays also operates resorts that are integrated with their parks, providing visitors with accommodation options for an extended stay. The company aims to create memorable and enjoyable experiences for its guests through a combination of thrilling rides, entertainment, and hospitality services.

The stocks has gained more than 140% in last 12 months.

4. Pitti Engineering | Best Performing Stocks 2024

Pitti Engineering Limited is an Indian company primarily engaged in manufacturing and providing solutions for precision-engineered components. The company focuses on various industries, including automotive, aerospace, and industrial sectors.

Why to invest in Pitti Engineering?

- Precision Engineering: Pitti Engineering is known for its expertise in precision machining and manufacturing of critical components. This includes components for the automotive industry, such as engine parts and transmission components.

- Aerospace Components: The company is involved in the production of precision components for the aerospace sector. These components may include parts for aircraft engines and other critical aerospace applications.

- Hydraulics and Other Industrial Segments: Pitti Engineering also operates in the hydraulics and industrial segments, providing components and solutions for diverse industrial applications.

The stocks has gained more than 117% in last 12 months.

5. NMDC | Best Performing Stocks 2024

NMDC Limited, formerly known as National Mineral Development Corporation, is a state-controlled mineral producer of the Government of India. It is one of the largest iron ore mining companies in India and has its headquarters in Hyderabad, Telangana. NMDC is involved in the exploration of various minerals, including iron ore, copper, rock phosphate, limestone, dolomite, gypsum, bentonite, magnesite, diamond, tin, tungsten, graphite, and beach sands.

Why to invest in NMDC?

- Iron Ore Production: NMDC is particularly renowned for its iron ore production and mining operations. It has mines in Chhattisgarh and Karnataka that contribute significantly to India’s iron ore requirements.

- Diverse Mineral Portfolio: While iron ore is a major focus, NMDC is involved in the exploration and production of various other minerals as well.

- Domestic and International Operations: While its primary operations are in India, NMDC has also explored opportunities for international mining projects.

- Government Ownership: NMDC is a public sector enterprise under the administrative control of the Ministry of Steel, Government of India. The government holds a majority stake in the company.

- Research and Development: NMDC is actively involved in research and development activities related to mineral exploration and mining technologies.

The stocks has gained more than 75% in last 12 months.

6. Indian Hume Pipe Company Ltd

Indian Hume Pipe Company Ltd (IHP) is a company established in 1926, specializing in manufacturing products for the construction and infrastructure sector. It is known for its involvement in water supply and sewerage projects, offering pre-stressed concrete pipes, precast concrete products, and related items.

Why to invest in Indian Hume Pipe Company Ltd?

The company plays a role in infrastructure and construction, emphasizing high-quality standards. IHP has diversified its product portfolio to include various concrete products. It has contributed to both public and private sector projects in India. For the latest information, it’s recommended to refer to official company communications.

The stocks has gained more than 70% in last 12 months.

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

7. DLF Ltd

DLF Limited is a major Indian real estate developer specializing in residential, commercial, and retail projects. Known for its pan-India presence, DLF focuses on creating integrated townships and has diversified into malls, hotels, and infrastructure. Stay updated on the company’s projects and performance by referring to its latest reports and official statements.

Why to invest in DLF Ltd?

DLF Limited, together with its subsidiaries, engages in the business of colonization and real estate development in India. The company develops and sells residential properties, such as land, plots, apartments, and commercial units; and commercial and retail properties. It also engages in the lease of developed office space, ITes, and retail properties.

In addition, the company owns and operates The Lodhi hotel and the Hilton Garden Inn in New Delhi; and golf and country clubs. Further, it engages in the provision of maintenance services; generation and sale of power; and recreational activities.

The stocks has gained more than 100% in last 12 months.

8. Lupin | Best Performing Stocks 2024

Lupin Limited is a prominent pharmaceutical company which has headquarter in Mumbai, India. Established in 1968, Lupin has grown to become a global player in the pharmaceutical industry. The company develops, manufacture, and market a wide range of pharmaceutical formulations, active pharmaceutical ingredients (APIs), and biotechnology products.

Why to invest in Lupin?

- Global Presence: Lupin operates in various international markets, with a significant presence in the United States, Europe, Asia, Latin America, Africa, and the Middle East.

- Therapeutic Focus: The company focuses on a diverse range of therapeutic areas, including cardiovascular, anti-infective, central nervous system, anti-diabetic, respiratory, and women’s health.

- Research and Development: Lupin has a strong emphasis on research and development, continually working on developing new drugs and formulations. The company invests in innovation to expand its product portfolio.

- Generics and Specialty Products: Lupin has expertise in generic drugs, but it has also expanded its portfolio to include specialty pharmaceuticals and complex generics.

- Manufacturing Facilities: Lupin operates multiple manufacturing facilities globally, adhering to high-quality standards and regulatory compliance.

The stocks has gained more than 84% in last 12 months.

9. Larsen & Toubro Ltd. | Best Performing Stocks 2024

Larsen & Toubro Limited (L&T) is a leading Indian multinational conglomerate with a diversified presence in engineering, construction, manufacturing, and technology services. Established in 1938, L&T has its headquarter in Mumbai, India, and operates globally.

Why to invest in L&T?

- Diversified Business: L&T operates in a wide range of sectors, including infrastructure, power, hydrocarbons, heavy engineering, information technology, defense, and financial services.

- Engineering and Construction: The company is renowned for its expertise in engineering and construction, undertaking major infrastructure projects such as roads, bridges, airports, and metro systems.

- Manufacturing: L&T has a strong manufacturing presence, producing a variety of products, including heavy machinery, electrical and electronic equipment, and industrial machinery.

- Technology Services: L&T provides comprehensive technology services, including information technology and engineering services, contributing to digital transformation and innovation.

- Global Footprint: L&T has a significant international presence, with operations and projects in multiple countries, making it one of India’s most globally competitive companies.

- Commitment to Sustainability: The company emphasizes sustainable and responsible business practices, integrating environmental and social considerations into its operations.

The stocks has gained more than 65% in last 12 months.

10. Kirloskar Brothers Ltd

Kirloskar Brothers Limited (KBL) is a leading Indian engineering conglomerate established in 1888. Specializing in fluid management solutions, KBL provides a diverse range of pumps for industries such as water supply, agriculture, and power. The company has a global presence, contributing to infrastructure projects and emphasizing sustainability in its operations. For the latest information, refer to official reports and statements from Kirloskar Brothers Ltd.

Why to invest in Kirloskar Brothers Limited (KBL)?

- Pump and Valve Manufacturer: KBL is a leading manufacturer of pumps and valves, offering a wide range of products for various industries, including water supply, irrigation, power, industrial, and oil and gas.

- Established Legacy: The company has a rich legacy dating back to 1888 when Laxmanrao Kirloskar founded the company. Over the years, KBL has established itself as a key player in the engineering and infrastructure sector.

- Diverse Product Portfolio: KBL’s product portfolio includes different types of pumps such as centrifugal pumps, submersible pumps, and special pumps for specific applications. The company also produces a variety of valves.

- Global Presence: Kirloskar Brothers has a global footprint, with operations and a distribution network in multiple countries. It serves a diverse customer base worldwide.

- Engineering Solutions: In addition to manufacturing pumps and valves, KBL provides engineering solutions for water management and fluid handling applications. The company is involved in projects related to water infrastructure and industrial processes.

- Commitment to Sustainability: Kirloskar Brothers emphasizes sustainable practices in its operations and products, contributing to efficient water management and environmental conservation.

The stocks has gained more than 180% in last 12 months.

To conclude

The stocks mentioned above have not only demonstrated impressive performance but also have the potential for further growth. However, it’s crucial for investors to conduct thorough research and consider their risk tolerance before making any investment decisions. As the market landscape continues to evolve, staying informed and adapting to changing trends will be key to successful investing in 2024.

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator