100 Rs Stocks in NSE, Best 100 Rs. Stocks in India

Best shares under 100 Rs., Invest 100 rs in stock market, Stocks Under 100 Rs, List of Best Shares under Rs. 100

100 Rs Stocks in NSE: Investing in the stock market can be both thrilling and intimidating, especially for beginners. While many investors dream of buying high-priced stocks, the truth is that there are numerous opportunities in the market that won’t break the bank. Today, we’ll explore the world of 100 Rs stocks in the National Stock Exchange (NSE) that have the potential to deliver substantial returns.

Recently we have seen the upward trend in Stock Market in India even when the global technology stocks are not performing well. There was a steep growth in stocks in the real estate, metal and energy sectors. If we talk about Top Gainers Shares, Eicher Motors, Adani Enterprises and Bharat Petroleum Corporation, ICICI Bank were among the Top Gainers Stocks in 2024. And if we talk about NSE top losers shares 2024 Power Grid Corporation, Zee Entertainment and UPL were among the Top Losers stocks in India.

Understanding 100 Rs Stocks

The term “100 Rs stocks” refers to stocks that are trading at or around the 100 Rupees mark per share. These stocks often belong to companies with smaller market capitalizations or those that may have been overlooked by mainstream investors.

Read Also | 6 things you Must know before market opens

Open bank account with no minimum balance requirement

Here in this article we will see about top 10 stocks to invest in 2024 under 100 Rs. which are undervalued and can perform well in the short term.

Click to Open Free UpStox Demat account/ Trading Account

Click to Open Free Sharekhan Demat Account / Trading Account

Advantages of Investing in 100 Rs Stocks:

- Affordable Entry Point: One of the primary advantages of investing in 100 Rs stocks is the low entry barrier. Investors with limited capital can diversify their portfolios without needing significant funds.

- Potential for High Returns: While higher-priced stocks can deliver substantial returns, 100 Rs stocks have the potential to experience significant percentage gains, leading to attractive returns on investment.

- Opportunity for Growth: Many 100 Rs stocks belong to emerging companies that have the potential to grow rapidly in the future. By investing early, investors can benefit from the growth trajectory of these companies.

List of Best 100 Rs Stocks in NSE

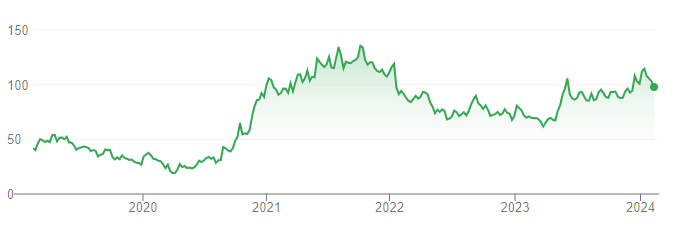

1. IDFC First Bank Ltd, 100 Rs Stocks in NSE

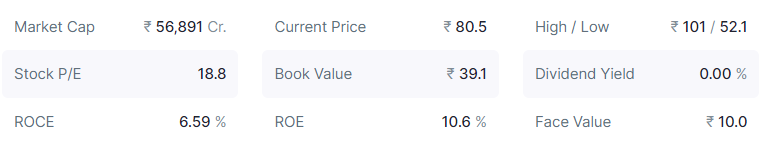

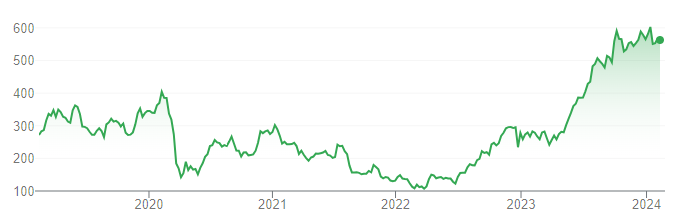

IDFC First Bank Ltd is a banking institution based in India. It was formed in November 2015 with the merger of IDFC Bank and Capital First. The bank offers various financial products and services including savings accounts, current accounts, fixed deposits, loans, insurance, and investment options. IDFC First Bank aims to cater to the banking needs of individuals, businesses, and corporates in India.

You may invest in this share at the level of Rs. 79-80 with a target of Rs. 92-93 per share.

IDFC Financials

Improve Credit Score, How improved CIBIL help

National Stock Exchange of India (NSE), Stocks listed on Nifty

Bombay Stock Exchange (BSE), Stocks listed on Sensex

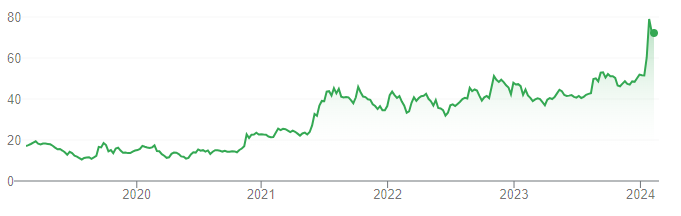

2. Ujjivan Small Finance Bank Ltd, Best 100 Rs Stocks in NSE

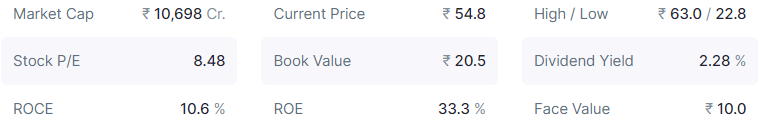

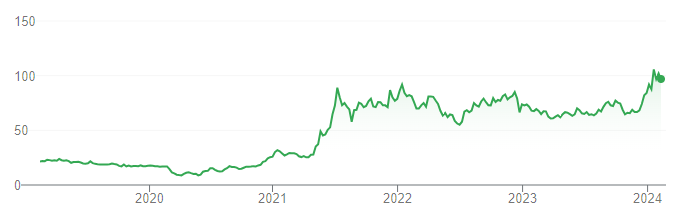

Ujjivan Small Finance Bank Ltd. is an Indian small finance bank that focuses on providing financial services to the underserved and unbanked segments of society, particularly in rural and semi-urban areas. It was established as a small finance bank in February 2017 and is headquartered in Bengaluru, Karnataka, India.

The bank is a subsidiary of Ujjivan Financial Services Ltd., which was initially a microfinance institution (MFI) serving low-income individuals and small businesses. The transformation into a small finance bank allowed Ujjivan to expand its range of financial products and services beyond microfinance.

Ujjivan Small Finance Bank offers a variety of banking services, including savings accounts, current accounts, fixed deposits, recurring deposits, loans, insurance products, and other financial services tailored to meet the needs of its target customer base.

The present price of the share is ranging between 54-55 Rs. per share. The P/E ratio of the share is above 8 and dividend yield is above 2%. You may invest in this share at the level of Rs. 56-57 with a target of Rs. 68-69 per share.

3. Steel Authority of India, Best 100 Rs Stocks in NSE

Steel Authority of India Limited is a central public sector undertaking based in New Delhi, India. It is under the ownership of the Ministry of Steel, Government of India with an annual turnover of ₹105,398 crore for the fiscal year 2022-23. Incorporated on 24 January 1973, SAIL has 59,350 employees.

The present price of the share is ranging between 93-95 Rs. per share. The P/E ratio of the share is above 12. You may invest in this share at the level of Rs. 75 – 80 with a target of Rs. 110-120 per share.

Click Here to get personalized help on how much to invest in share market for beginners

How do they decide Stocks Upper Circuit limit

Financial Planning for your child’s Education

4. HFCL, Best Stocks Under 100 2024

HFCL Limited is an Indian technology company, based in Gurugram. It designs, develops, manufactures telecommunications equipment, fibre-optic cables and other related electronics. The company is listed on both the Bombay Stock Exchange and on the National Stock Exchange.

The present price of the share is ranging between 95-96 Rs. per share. The P/E ratio of the share is above 30. You may invest in this share at the level of Rs. 92-94 with a target of Rs. 112-113 per share.

5. Bhansali Engg Polymers, Best 100 Rs Stocks in NSE

The company is engaged in manufacturing ABS resins, AES resins, ASA resins, SAN resins, and their alloys with other plastics. Its products are used in home appliances, automobiles, electronics, healthcare and kitchenware. The company has two manufacturing facilities with a total capacity of 137 thousand tonnes per annum.

It is planning to increase its capacity further to 200,000 tonnes per annum by December 2024 with an investment of Rs 5 billion (bn), which it plans to fund entirely through internal resources to retain its debt-free status.

Bhansali Engineering Polymers also has an in-house state-of-the-art research and development (R&D) facility where it is developing some important raw materials which it primarily imports from abroad.

The present price of the share is ranging between 97-98 Rs. per share. The P/E ratio of the share is above 16. You may invest in this share at the level of Rs. 96 – 97 with a target of Rs. 122-128 per share.

Get personalized help on investment in current IPOs.

How ASM Framework restricted 20 stocks including Adani Wilmar to get more investors?

Muhurat Trading: Know Everything in detail, Timing, Tips

6. Geojit Financial Services Ltd, Best 100 Rs Stocks in NSE

Geojit Financial Services Ltd. is a leading retail stock brokerage firm based in India. It offers a range of financial services including stock trading, mutual funds, portfolio management services, and investment advisory services. Geojit operates through a network of branches and online platforms, allowing clients to trade in equities, derivatives, currencies, commodities, and more.

The company was founded in 1987 by C. J. George and Ranajit Kanjilal. It is headquartered in Kochi, Kerala, India. Over the years, Geojit has expanded its presence across India and has a significant customer base.

Geojit Financial Services Ltd. is popular for its research and advisory services which provide investors with insights and analysis to make informed investment decisions. The company has earned a reputation for its customer service and technological innovations in the financial services sector.

The present price of the share is ranging between 76 -77 Rs. per share. You may invest in this share at the level of Rs. 72-74 with a target of Rs. 96-98 per share.

7. Southern Petrochemicals Industries Corporation Ltd

Southern Petrochemical Industries Corporation Limited (SPIC) is a prominent Indian company. It is the manufacture and seller of fertilizers, industrial chemicals, and trading of petrochemicals. It was established in 1969 and is headquartered in Chennai, Tamil Nadu, India.

SPIC’s primary products include fertilizers such as urea, ammonia, complex fertilizers, and other industrial chemicals like sulfuric acid, oleum, and phosphoric acid. The company also engages in trading activities related to petrochemicals.

Over the years, SPIC has played a significant role in India’s agricultural and industrial sectors, contributing to the country’s self-sufficiency in fertilizer production and serving the needs of various industries.

The company has undergone strategic restructuring and expansions to enhance its production capacities and diversify its product portfolio, aligning with the evolving needs of the market and ensuring sustainable growth.

The present price of the share is ranging between 87-88 Rs. per share. You may invest in this share at the level of Rs. 85-86 with a target of Rs. 98-100 per share.

Read this: The Complete Penny Stock Course: Learn How to Generate Profits Consistently by Trading Penny Stocks

8. Dwarikesh Sugar Industries Ltd

Dwarikesh Sugar Industries Ltd. is a well-known company in the sugar industry based in India. It is one of the leading integrated sugarcane processing companies in India. The company is involved in various activities related to sugar production, including the manufacture of sugar, ethanol, and power.

Dwarikesh Sugar operates sugar mills where sugarcane is crushed to produce sugar. Sugar production is one of its primary activities, and the company is famous for producing high-quality sugar. In addition to sugar, Dwarikesh Sugar is also produce ethanol. Ethanol is produced from sugarcane and is commonly used as a biofuel additive in gasoline.

Dwarikesh Sugar has power cogeneration facilities that utilize sugarcane byproducts such as bagasse (the fibrous residue left after sugarcane crushing) to generate electricity. This helps the company meet its energy requirements and also allows for surplus electricity to be supplied to the grid.

The present price of the share is ranging between 80-81 Rs. per share. You may invest in this share at the level of Rs. 78-79 with a target of Rs. 110-112 per share.

9. Tamil Nadu Petro Products Ltd

Tamil Nadu Petro Products Ltd is a public sector enterprise located in Manali, Chennai, Tamil Nadu, India. It was established in 1984 and is engaged in the production of Linear Alkyl Benzene (LAB), Caustic Soda, and Chlorine. These chemicals find application in various industries such as detergents, pharmaceuticals, textiles, and water treatment.

The company operates under the purview of the Tamil Nadu Industrial Development Corporation (TIDCO) and the Tamil Nadu Government. It plays a significant role in the industrial landscape of Tamil Nadu by contributing to the production of essential chemicals used in various sectors.

Tamil Nadu Petro Products Ltd has undergone several expansions and modernization initiatives over the years to enhance its production capacity and efficiency. It continues to be a key player in the chemical industry in India, catering to both domestic and international markets.

The present price of the share is ranging between 93Rs. per share. You may invest in this share at the level of Rs. 85-87 with a target of Rs. 112-120 per share.

10. Pudumjee Paper Products Ltd

Pudumjee Paper Products Ltd is an Indian company that operates in the paper and packaging industry. It is part of the Pudumjee Group, which has a long history in the paper manufacturing sector. Pudumjee Paper Products Ltd is famous for producing a variety of paper products including printing and writing paper, specialty paper, and packaging paper.

The company has a diverse range of customers across different industries including publishing, education, packaging, and more. Pudumjee Paper Products Ltd focuses on maintaining high-quality standards in its products and adhering to environmentally sustainable practices in its manufacturing processes.

The present price of the share is ranging between 70-71 Rs. per share. You may invest in this share at the level of Rs. 68-69 with a target of Rs. 92-93 per share.

Disclaimer: This blog is for educational purposes. The securities quoted are exemplary and are not recommendatory.

Get personalized help on investment in current IPOs.

How ASM Framework restricted 20 stocks including Adani Wilmar to get more investors?

Muhurat Trading: Know Everything in detail, Timing, Tips

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator