Top 5 Penny Stocks Below 1 Rs to invest 2024

Best Penny Stocks Below Rupee 1 in India

Top 5 Penny Stocks Below 1: Penny stocks, often defined as stocks trading at a low share price, can be an enticing prospect for investors looking to enter the stock market with minimal capital. They offer the potential for significant gains but also carry substantial risks.

Penny stocks, those elusive gems trading below the 1 Rs mark, have a magnetic appeal for investors seeking potential high returns within the volatile landscape of the stock market. These stocks, often overlooked due to their low price, can sometimes harbor immense potential and opportunity for astute investors.

We will delve into the intriguing world of penny stocks, uncovering five companies that have captured the attention of market enthusiasts with their compelling narratives and promising prospects.

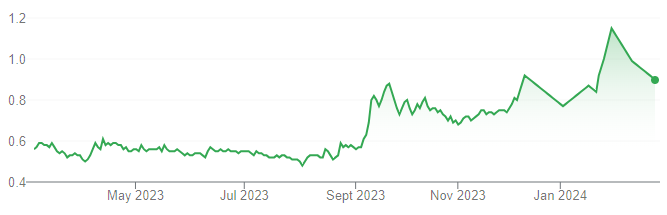

1. Kretto Syscon Ltd | Penny Stocks Below 1

Kretto Syscon Ltd (formerly known as Ideal Texbuild Ltd) is a public limited company incorporated on 19th September 1994. The company has its registered office at Ahmedabad in the state of Gujarat. The main business of the company is textiles and building construction.

Stock Tip: The stock is trading at Rs. 0.90 per share. The stock is expected to touch 1.85 levels in near future. Company is almost debt free. Stock is trading at 0.85 times its book value.

Top 5 Competitors

| S.No. | Name | CMP Rs. |

|---|---|---|

| 1. | Macrotech Devel. | 1110.15 |

| 2. | Rail Vikas | 264.60 |

| 3. | NCC | 254.70 |

| 4. | PNC Infratech | 424.40 |

| 5. | National Standar | 5155.10 |

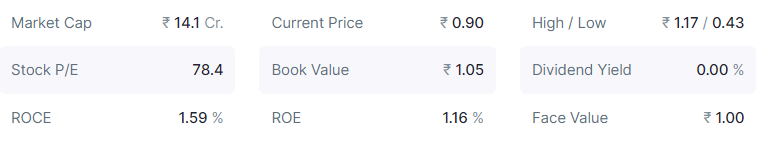

2. Seven Hill Industries Ltd | Penny Stocks Below 1

The company is engaged in the business of non-banking financial services such as trading in shares and securities, investment, loans and advances. Apart from this, it is also present in the business of software trading.

Stock Tip: The stock is trading at Rs. 0.86 per share. The stock is expected to touch 1.55 levels in near future.

Top 5 Competitors

| S.No. | Name | CMP Rs. |

|---|---|---|

| 1. | Bajaj Finance | 6697.85 |

| 2. | Bajaj Finserv | 1616.55 |

| 3. | Jio Financial | 333.95 |

| 4. | Bajaj Holdings | 8755.80 |

| 5. | Cholaman.Inv.&Fn | 1105.40 |

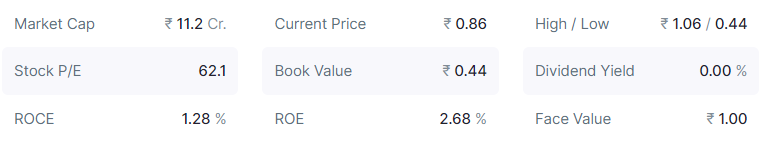

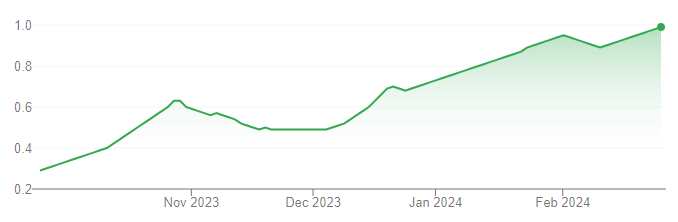

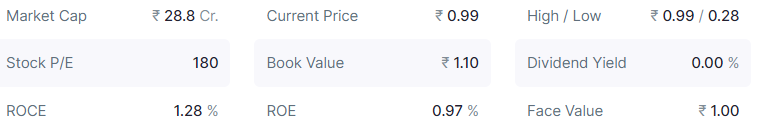

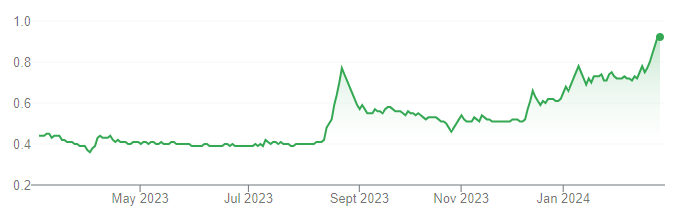

3. Jackson Investments Ltd | Penny Stocks Below 1

Jackson Investments is into the business of Finance and Investments. The activities of the company includes financing, investing in shares & other securities, Commodities and other related activities of capital market.

Stock Tip: The stock is trading at Rs. 0.99 per share. The stock is expected to touch 1.88 levels in near future. Company is almost debt free. Stock is trading at 0.90 times its book value

Top 5 Competitors

| S.No. | Name | CMP Rs. |

|---|---|---|

| 1. | Bajaj Finance | 6697.85 |

| 2. | Bajaj Finserv | 1616.55 |

| 3. | Jio Financial | 333.95 |

| 4. | Bajaj Holdings | 8755.80 |

| 5. | Cholaman.Inv.&Fn | 1105.40 |

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

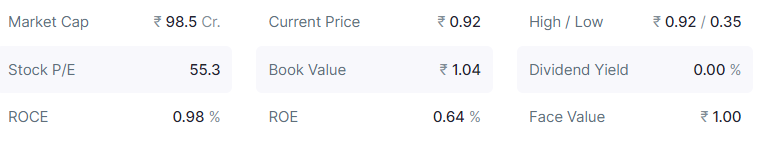

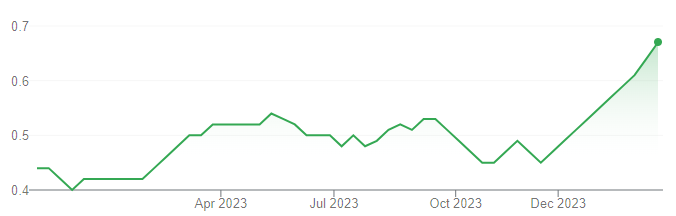

4. NCL Research and Financial Services Ltd

Incorporated in 1985, NCL Research and Financial Services Ltd is engaged in the business of finance and investments in capital market. The company is in activities of trading of Textiles products apart from investing activities in Shares and Securities. The companies one of the RBI registred NBFC company and is into the business finance as well as investments in Shares and Securities.

Stock Tip: The stock is trading at Rs. 0.92 per share. The stock is expected to touch 1.68 levels in near future. Company is almost debt free. Stock is trading at 0.88 times its book value.

Top 5 Competitors

| S.No. | Name | CMP Rs. |

|---|---|---|

| 1. | Bajaj Finance | 6697.85 |

| 2. | Bajaj Finserv | 1616.55 |

| 3. | Jio Financial | 333.95 |

| 4. | Bajaj Holdings | 8755.80 |

| 5. | Cholaman.Inv.&Fn | 1105.40 |

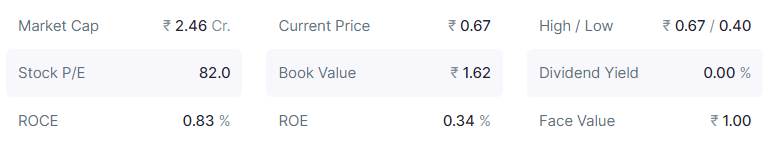

5. Classic Global Finance & Capital Ltd

Classic Global Finance & Capital carry on investment business and to purchase, acquire, subscribe, hold, and dispose of or otherwise invest/deal in shares, debentures, bonds, obligations and securities, etc.

Stock Tip: The stock is trading at Rs. 0.67 per share. The stock is expected to touch 1.32 levels in near future. Stock is trading at 0.41 times its book value.

Top 5 Competitors

| S.No. | Name | CMP Rs. |

|---|---|---|

| 1. | Bajaj Finance | 6697.85 |

| 2. | Bajaj Finserv | 1616.55 |

| 3. | Jio Financial | 333.95 |

| 4. | Bajaj Holdings | 8755.80 |

| 5. | Cholaman.Inv.&Fn | 1105.40 |

Conclusion

While these penny stocks below 1 Rs may offer the allure of significant returns, investors should approach them with caution and conduct thorough due diligence before making any investment decisions.

It’s essential to consider factors such as the company’s financial health, competitive positioning, industry dynamics, and regulatory environment.

Moreover, investors should diversify their portfolios and allocate only a small portion of their capital to penny stocks, given the heightened risks involved.

While the potential for outsized gains exists, so too does the risk of substantial losses, making prudent risk management paramount.

In conclusion, investing in penny stocks below 1 Rs can be a speculative venture that requires careful consideration and risk assessment.

While these stocks may offer short-term trading opportunities, they are inherently volatile and subject to significant fluctuations. Therefore, investors should approach penny stock investing with caution, diligence, and a long-term perspective to navigate the complexities of the market effectively.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator