What Is a Cancelled Cheque and How to Write One?

Cancelled Cheques: What Are They and How to Use Them? Is It Safe To Issue Cancelled Cheque?

Cancelled Cheque: A cancelled cheque is a crucial document used in various financial transactions as a proof of account ownership and authenticity. It essentially serves as a blank cheque with the word “CANCELLED” marked across it, rendering it unusable for transactions involving withdrawals or transfers of funds. Here, we’ll delve into the specifics of what a cancelled cheque is, how to write one, its significance in different contexts, and related queries.

In response to the growing demand for information on cancelled cheques, numerous online resources, including banking websites, financial forums, and educational platforms, offer valuable insights and guidance on this topic. From step-by-step tutorials to expert advice, individuals have access to a wealth of information that can help demystify the concept of cancelled cheques and empower them to navigate financial transactions with confidence.

Understanding the Purpose of Cancelled Cheque

What Is a Cancelled Cheque?

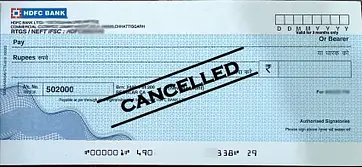

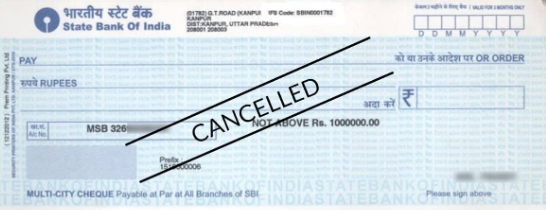

A cancelled cheque is a cheque that has been rendered invalid by drawing two parallel lines across it and marking it as “CANCELLED.” It is typically used for verification of bank account details, such as account number, branch name, and MICR (Magnetic Ink Character Recognition) code. The cancellation of the cheque ensures that it cannot be misused for unauthorized transactions.

How to Write a Cancelled Cheque?

Writing cancelled cheques is a simple process:

- Take a blank cheque leaf from your chequebook.

- Fill in all the necessary details such as your name, account number, date, and amount (you can mark it as “Not Applicable” or leave it blank).

- Draw two parallel lines across the cheque, prominently writing “CANCELLED” between them.

- Ensure that the writing is clear and legible to avoid any confusion.

Can I Tear a Cancelled Cheque?

Yes, you can tear cancelled cheques once you have used it for verification purposes. However, it’s advisable to keep a record of it for your own reference, especially if you might need it for future transactions or documentation.

Can I Download a Cancelled Cheque Online?

Many banks offer online facilities to download cancelled cheques images from their internet banking portals. You can log in to your account, navigate to the relevant section, and download the image of cancelled cheques associated with your account.

What Can Be Used Instead of a Cancelled Cheque?

In lieu of cancelled cheques, one can use other documents such as bank account statements, passbook copies, or account verification letters issued by the bank for verification purposes in certain scenarios. However, cancelled cheques remain the most commonly requested document for various financial transactions.

Why Is a Cancelled Cheque Required?

Cancelled cheques are often required for a variety of purposes such as:

- Setting up electronic fund transfers (EFT)

- Initiating automatic bill payments

- Verifying bank account details for loans, investments, or insurance policies

- Processing employee salary payments

- Activating new investment accounts or trading platforms

Know RBI Norms about cheques: Click Here

Additional Considerations:

- Cancelled Cheque Signature Requirement: Usually, a cancelled cheque does not require a signature. The cancellation markings serve as the primary authentication.

- Cancelled Cheque Image: The image of a cancelled cheque typically displays the bank’s logo, account details, and the prominent “CANCELLED” marking.

- Cancelled Cheque Sample: Above you can find sample images of cancelled cheques online, these can guide you on how to properly cancel a cheque.

Furthermore, the internet serves as a platform for individuals to share personal experiences and insights regarding bank cheques. Through online communities and social media platforms, people engage in discussions, seek advice, and offer solutions based on their own encounters with cheque-related situations.

Conclusion

In conclusion, cancelled cheques are vital document in financial transactions, serving as a tangible proof of bank account details. Knowing how to write cancelled cheques and understanding its significance can streamline various administrative processes and ensure smooth financial transactions. While alternatives exist, cancelled cheques remains a preferred method for verifying bank account information due to its simplicity and reliability. Always exercise caution when sharing such sensitive financial documents and keep records for your own reference and security.

Also Read

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator