AU Small Finance Bank, Apply AU Credit Card, Net Banking, Loan

AU small finance bank services and products, Apply AU small finance bank credit card, AU bank net banking

AU small finance bank: In the dynamic landscape of the financial sector, AU Small Finance Bank has emerged as a beacon of success, redefining the way banking is perceived and experienced. Established in 1996 as vehicle finance company AU Financiers (India) Ltd, the institution transitioned into a small finance bank in 2017, marking a significant milestone in its journey. Let’s explore AU Bank’s services and products in India.

AU Small Finance Bank Services and Products

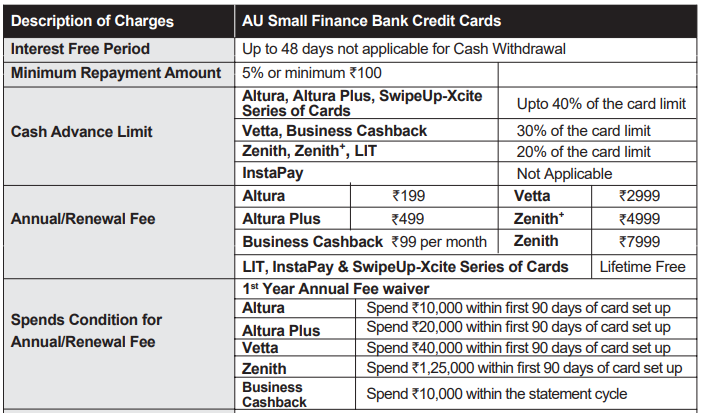

AU Small Finance Bank Credit Cards

The AU Bank has ventured into the credit card space, introducing a range of cards with features tailored to suit the lifestyle and preferences of its customers. Key features include:

- Reward Programs: Earn rewards on every transaction, redeemable for a variety of options, including travel, shopping, and more.

- Customized Spending Limits: AU Bank understands the unique needs of its customers, offering flexible spending limits to align with individual financial preferences.

- Contactless Payments: The credit cards are equipped with contactless payment technology, providing a secure and convenient way to make transactions.

Click to Apply AU Small Finance Bank Credit Card Now

Download AU Small Finance Bank Credit Card Application Form

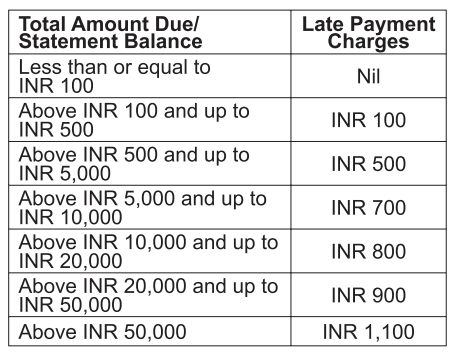

AU SMALL FINANCE BANK CREDIT CARD LATE PAYMENT CHARGES

AU Small Finance Bank Credit Card Customer Care Number and Email ID

The Cardholder can contact AU Small Finance Bank Credit Cards for making any inquiries or for any grievance redressal through:

24X7 hours AU Bank Credit Card call centre number: 1800 1200 1500

AU Bank Credit Card Email Id: creditcard.support@aubank.in;

AU Bank Net Banking

- AU Bank’s net banking platform is a user-friendly and secure interface that empowers customers to manage their finances from the comfort of their homes or offices.

- Account Management: View account balances, transaction history, and download statements with ease.

- Fund Transfers: Transfer funds seamlessly between AU Bank accounts or to accounts in other banks.

- Online Bill Payments: Pay bills, recharge mobiles, and settle other utility payments conveniently through the net banking portal.

Click to Apply AU Small Finance Bank Net Banking Now

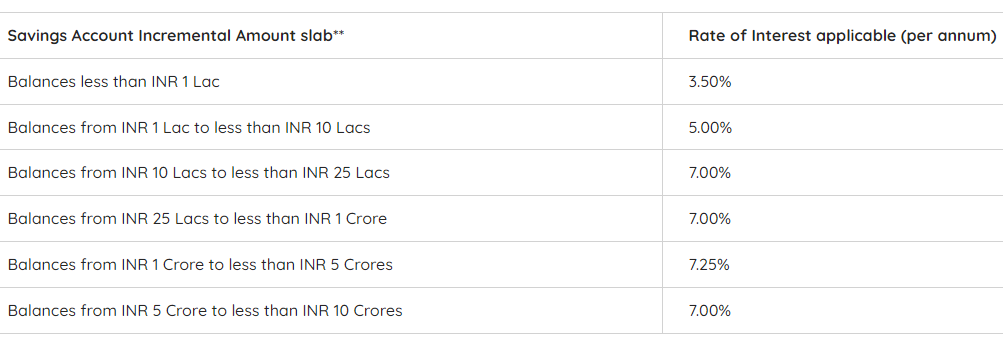

AU Bank Savings Account:

- AU Bank offers a variety of savings accounts to cater to the diverse financial needs of its customers.

- Basic Savings Account: A standard account with essential features for everyday banking needs.

- Premium Savings Account: Tailored for customers seeking additional benefits such as higher interest rates, personalized services, and exclusive privileges.

- Digital Savings Account: Embracing the digital age, this account provides the convenience of online banking with advanced features.

Click to Apply for AU Small Finance Bank Saving Account

AU Bank Saving Account Eligibility Criteria

- If you reside in India, are 18 years or above, and have the necessary KYC documents issued by the government, you can open a Savings Account with us.

How to apply for AU Digital Savings Account?

- Video Banking: You can open an AU Savings Account through our Video Banking service by clicking here. All you need is your PAN Card & Aadhaar Card.

- Call Customer Care: You can also apply for AU Savings Account by calling our customer care number 1800-1200-1200.

Documents required for AU Digital Savings Account

You need to have the following documents to open an AU Digital Savings Account:

- Aadhaar Card

- Pan Card

- Photograph

AU Bank Personal Loans

AU Small Finance Bank’s personal loan offerings cater to various needs such as education, medical emergencies, and other personal expenses. The bank’s quick and hassle-free loan approval process has been a key factor in its popularity.

Eligibility criteria

- You should be an Indian resident.

- You should be of minimum 23 years of age at the time of loan application and a maximum of 60 years at the time of loan maturity.

- You can avail of a Personal Loan for a minimum repayment tenure of twelve months and a maximum repayment duration of five years.

- You may apply for an amount up to INR 10,00,000.

Click here to Apply AU Small Finance Personal Loan

Conclusion:

AU Finance Bank’s commitment to innovation and customer satisfaction is evident in its diverse array of services and products. Whether it’s the convenience of net banking, the flexibility of credit cards, or the stability of savings accounts, AU Small Bank continues to empower individuals and businesses alike.

As investors keep a watchful eye on share prices, the bank’s dedication to financial inclusion and customer-centric solutions positions it as a key player in the dynamic world of finance. With a focus on adapting to changing times and meeting evolving customer needs, AU Small Finance is poised to play a pivotal role in shaping the future of banking.

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator