Top 5 Best Stocks to invest in 2024 Under 50 Rs.

Undervalued shares in India, Buy Penny Stocks multi bagger stocks below Rs. 50, Top 5 Stocks to buy for short term

Top 10 Stocks under 50 Rs. – Welcome to the world of smart investing! In 2024, the stock market continues to be a hub of opportunities, and you don’t need a hefty budget to be part of the action. This blog explores the Top 5 Stocks to Invest in under 50 Rs., offering a gateway to potential financial growth without breaking the bank. Whether you’re a seasoned investor or a newcomer to the market, these carefully selected stocks present a diverse range of prospects across various sectors.

Each stock on this list is poised to make waves in the coming year. Join us on a journey through budget-friendly investments that have the potential to yield impressive returns, proving that you don’t need a massive investment to make a significant impact in your portfolio. Get ready to explore the exciting landscape of affordable yet promising stocks in 2024!

Read Also | 6 things you Must know before market opens

| Hoe to Open bank account with no minimum balance requirement

Here in this article we will see about top 5 stocks to invest in 2024 under 50 Rs. which are undervalued shares and can perform well in the short term.

Click to Open Free UpStox Demat account/ Trading Account

Click to Open Free Sharekhan Demat Account / Trading Account

Which stocks should be in portfolio?

Building a well-balanced portfolio involves careful consideration of various factors to maximize returns while managing risks. Diversification is key, and a solid portfolio typically includes a mix of stocks from different sectors, sizes, and risk profiles. Blue-chip stocks, characterized by stability and consistent dividends, can form the core of a portfolio, providing a foundation for long-term growth. Growth stocks, which have the potential for substantial capital appreciation, add dynamism. Including value stocks, often undervalued by the market, can provide stability and income.

Furthermore, consider allocating a portion to emerging market stocks for higher growth potential. Dividend-paying stocks contribute regular income, while defensive stocks can act as a hedge during market downturns. Regularly reviewing and rebalancing the portfolio ensures alignment with financial goals and market conditions. Ultimately, a well-diversified portfolio is tailored to an individual’s risk tolerance, investment horizon, and financial objectives.

Is it good to have penny stocks in portfolio?

Investing in penny stocks can be a double-edged sword, offering both potential rewards and considerable risks. While these low-priced securities may seem attractive due to their affordability, investors should exercise caution. Penny stocks often belong to smaller, less-established companies, making them more susceptible to volatility and market manipulation.

Their low share prices can lead to significant percentage gains, but they are equally prone to substantial losses. Stocks under 50 Rs. in India may balance your portfolio and offer the thrill of high returns.

1. Vakrangee Ltd NSE : VAKRANGEE

Vakrangee Ltd is a prominent Indian technology and e-governance solutions company that has garnered attention for its innovative offerings. Established in 1990, Vakrangee has evolved into a key player in providing last-mile retail delivery points for essential services. The company operates an extensive network of Vakrangee Kendras, serving as touchpoints for various digital services, financial inclusion, and e-commerce transactions.

Why to invest in Vakrangee? Stocks under 50 Rs.

The company leverages technology to empower citizens in rural and semi-urban areas by offering them access to a wide array of digital and financial services. Vakrangee’s commitment to financial inclusion and digital empowerment aligns with India’s broader vision of creating a digitally inclusive society. As the company continues to expand its footprint, it remains a notable player in driving digital accessibility across the nation.

Key Stats

- Market Cap ₹ 2,214 Cr.

- Current Price ₹ 20.9

- High / Low ₹ 25.3 / 13.3

- Stock P/E – 1,375

- Book Value ₹ 1.13

- Dividend Yield 0.24 %

- ROCE 2.65 %

- ROE 0.87 %

- Face Value ₹ 1.00

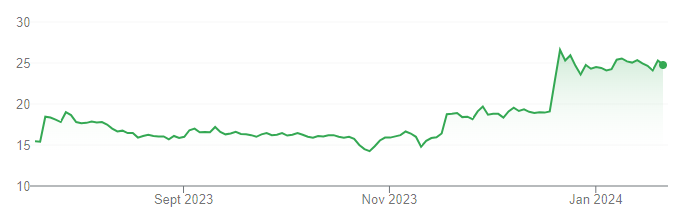

Stock Performance –

Expert Note: The stock is expected to reach Rs. 30-32 levels in near future.

2. S.A.L Steel Ltd NSE – BE : SALSTEEL

S.A.L Steel Ltd is a reputable player in the steel industry, recognized for its commitment to quality and innovation. With a robust presence in the market, S.A.L Steel has earned a commendable reputation for delivering high-grade steel products. The company’s focus on cutting-edge technologies and sustainable practices positions it as a leader in the steel manufacturing sector.

Read Now | Stock Market Crash Today; Steps to recover your loss

Why to invest in this penny stock? Best Stocks under 50 Rs.

S.A.L Steel Ltd’s diverse product portfolio caters to various industries, reflecting its adaptability and market responsiveness. Renowned for its reliability and customer-centric approach, S.A.L Steel continues to be a preferred choice for businesses seeking top-notch steel solutions.

Key Stats

- Market Cap ₹ 210 Cr.

- Current Price ₹ 24.7

- High / Low ₹ 27.5 / 12.9

- Stock P/E 223

- Book Value ₹ 4.93

- Dividend Yield 0.00 %

- ROCE 8.12 %

- ROE 8.95 %

- Face Value ₹ 10.0

Stock Performance –

Expert Note: The stock is expected to reach Rs. 32-33 levels in near future.

3. Shyam Century Ferrous Ltd NSE : SHYAMCENT

Shyam Century Ferrous Ltd is a prominent player in the ferrous metallurgy sector, recognized for its commitment to excellence and innovation. Specializing in the production of high-quality ferrous alloys, the company has established a strong foothold in the market. Shyam Century Ferrous Ltd is known for its state-of-the-art manufacturing facilities, employing cutting-edge technology to deliver products that meet stringent industry standards.

Why to invest in this penny stock? Best Stocks under 50 Rs.

With a customer-centric approach, the company has earned a reputation for reliability and product consistency. As a key contributor to the ferrous industry, Shyam Century Ferrous Ltd continues to play a pivotal role in shaping the future of metallurgical advancements, ensuring a sustainable and dynamic presence in the market.

- Company is almost debt free.

- Company has delivered profit growth of 20.6% CAGR over last 5 years.

- Company’s working capital requirements have reduced marginally.

Key Stats

- Market Cap ₹ 547 Cr.

- Current Price ₹ 25.8

- High / Low ₹ 32.4 / 15.3

- Stock P/E 38.2

- Book Value ₹ 7.62

- Dividend Yield 1.16 %

- ROCE 21.8 %

- ROE 15.9 %

- Face Value ₹ 1.00

Stock Performance –

Expert Note: The stock is expected to reach Rs. 38-39 levels in near future.

4. Basant Agro Tech (India) Ltd BSE: 524687

Basant Agro Tech (India) Ltd is a dynamic player in the agricultural sector, carving its niche as a leading agro-tech company in India. With a commitment to innovation and sustainability, Basant Agro Tech focuses on delivering cutting-edge solutions to farmers, enhancing agricultural productivity and efficiency. The company engages in the research, development, and distribution of advanced agricultural technologies, including seeds, fertilizers, and crop management solutions.

Why to invest in this penny stock? Best Stocks Below 50 Rs. in India

Basant Agro Tech takes pride in its farmer-centric approach, providing tailored solutions to address the diverse needs of the agricultural community. Through strategic partnerships and a dedicated team of experts, the company strives to contribute to the growth of the agricultural industry while ensuring environmental stewardship.

With a vision to empower farmers and promote sustainable agriculture practices, Basant Agro Tech (India) Ltd stands as a beacon of innovation and progress in the ever-evolving landscape of agro-technology. Also the company has delivered good profit growth of 23.8% CAGR.

Key Stats

- Market Cap ₹ 214 Cr.

- Current Price ₹ 23.6

- High / Low ₹ 28.6 / 14.9

- Stock P/E 31.8

- Book Value ₹ 18.7

- Dividend Yield 0.34 %

- ROCE 11.4 %

- ROE 11.0 %

- Face Value ₹ 1.00

Stock Performance –

Expert Note: The stock is expected to reach Rs. 32-33 levels in near future.

5. Hathway Cable & Datacom Ltd NSE : HATHWAY

Hathway Cable & Datacom Ltd is a prominent player in the Indian telecommunications and cable TV industry. As one of the leading broadband and cable television service providers, Hathway has established a strong presence in major urban markets. The company is known for delivering high-speed internet services, digital cable television, and value-added services, catering to the diverse entertainment and communication needs of its customers.

Why to invest in this penny stock? Best Stocks under 50 Rs. in India

With a commitment to technological innovation and customer satisfaction, Hathway Cable & Datacom Ltd continues to be a key player in shaping the digital connectivity landscape in India. As the demand for reliable broadband services continues to grow, Hathway’s strategic positioning and focus on quality services position it as a noteworthy entity in the evolving telecommunications sector.

- Company is almost debt free.

- Stock is trading at 1.00 times its book value

Key Stats

- Market Cap ₹ 4,231 Cr.

- Current Price ₹ 23.9

- High / Low ₹ 26.1 / 12.2

- Stock P/E 78.8

- Book Value ₹ 23.9

- Dividend Yield 0.00 %

- ROCE 2.15 %

- ROE 1.55 %

- Face Value ₹ 2.00

Stock Performance –

Expert Note: The stock is expected to reach Rs. 39-40 levels in near future.

Conclusion

Investing under 50 Rs. doesn’t mean compromising on potential returns. The stocks mentioned above offer a diverse range of opportunities across different sectors, providing investors with affordable entry points into promising companies. As with any investment, it’s crucial to conduct thorough research and, if necessary, consult with financial experts before making decisions. Happy investing!

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator