Improve Credit Score, How improved CIBIL help

Need a loan! maintain good credit score. Tips to improve your credit score. Increase chances of getting a loan.

Whenever we go to avail a loan facility whether it is housing loan, personal loan, car loan, business loans or credit card, the first thing is asked for credit score as eligibility criteria. Most of the lenders self generate this credit score from their own without informing or disclosing its report or score to the customer. In this article read about how to Improve Credit Score, and how it can help you financially.

The credit report is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks.

Read about How to manage EMIs to pay back less

Most of the companies are generating CIBIL credit reports. A person himself can generate a credit report by logging in to the CIBIL website.

There are some websites which are providing a facility to generate credit reports for free (Generally for the first time). However, generating credit scores frequently may have an adverse impact on your credit score so it is advised to generate a credit report when you really need one.

Factors that contribute to a higher credit score :

- History of on-time payments,

- Low balances on your credit cards,

- Different credit card and loan accounts,

- Older credit accounts,

- Minimal inquiries for new credit.

- Late or missed payments,

- High credit card balances, collections,

- Judgments

Learn What does -1 CIBIL score mean?

How Credit Companies determine Credit report:

- Payment history (35%)

- Credit usage (30%)

- Age of credit accounts (15%)

- Credit mix (10%)

- New credit inquiries (10%)

How to Improve credit score

There are a number of things that you can do. It takes a bit of effort and, of course, some time. Here’s a step-by-step guide to achieving a better credit score.

Pull a copy of your credit report from each of the major companies CIBIL, Equifax, Experian, and CRIF..

- Check your credit score to see why it is low.

- Pay down your revolving credit as much as possible to lower your credit utilization percentage.

- Have any inaccurate things removed (especially late payments).

- Keeping track of monthly bills (EMIs)

- Automating bill payments from your bank account,

- Pay your credit card balances in full each month or keep your total outstanding balance at 30% or less of your total credit limit.

- Ask for a credit limit increase.

- Keep Old Accounts Open and Deal with Delinquencies like payoff old credit cards which you don’t use presently.

See 15 Tips and Tricks to save income Tax

Anurag Sinha, Co-founder and CEO, OneScore and OneCard, says, “Before extending any form of credit, a potential borrower’s credit behavior is thoroughly analyzed by credit bureaus and the score is given out of 900.”

Details of credit report companies can be seen below –

- CIBIL – https://www.cibil.com

- CIBIL Contact No. 022-61404300

- Experian – https://www.experian.in/

- Experian Contact No. 022 6641 9000

- Equifax – https://www.equifax.com/

- Equifax Contact No. 1800 209 3247

- CRIF – https://www.crifhighmark.com/

- CRIF Contact No. +91-22-71712900

| Parameter | CIBIL Charges | Equifax Charges | Experian Charges | CRIF Highmark Charges |

| Per Report Charges | Rs.550 for Credit Report + Score. | Rs.400 (excluding GST) for Credit Report + Score | Rs.399 for Credit Report + Credit Score) | Rs.399 (including GST) Credit Report + Credit Score |

Know how Instant Personal Loan Impact CIBIL

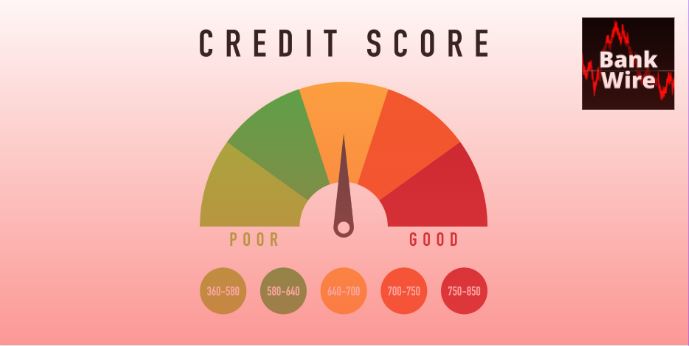

Credit Score Range: Which score is good CIBIL Score and bad CIBIL Score

Credit scores normally are in the range between 300 – 900, wherein a score

- >= 750 is termed as excellent showing responsible financial prudence

- 600-750 is termed average score with a slightly high-risk affinity

- < 600 implies poor credit rating leading to rejection of loan/credit card approval.

To conclude, it is necessary to maintain a good financial track to avail facilities from institutions and banks in India. The role of credit report is very significant and can affect the decision of lenders positively or negatively.

Other Posts:

- Cash deposit limit in savings account for individual

- Reason for personal loan rejection

- Cyber Fraud: Type of banking fraud, Recover lost money

- Cheapest Two-wheeler Loan, Compare interest rates of all banks

- Financial Planning for your child’s Education

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator