Top 10 Blue Chip Stocks to Invest in India

List of Blue Chip Stocks to Buy in India, Top Performing Blue Chip Stocks in India

Blue Chip Stocks to Invest in India: In the dynamic world of Indian stock market investing, blue-chip stocks remain a cornerstone for building robust portfolios. These stocks, known for stability and consistent performance, offer investors an opportunity for long-term wealth creation. Here’s a curated list of the top 10 blue-chip stocks to consider for investment in India:

1. Reliance Industries Limited (RIL):

Reliance Industries Limited (RIL) is a diversified conglomerate with interests in energy, petrochemicals, retail, and telecommunications. Led by visionary leadership, RIL stands as one of India’s largest and most influential companies, driving innovation and growth across various sectors.

With a track record of consistent performance and a commitment to excellence, RIL remains a cornerstone of the Indian economy. Also, a top choice for investors seeking stability and long-term value.

Financial Details:

- Market Cap ₹ 19,56,373 Cr.

- Current Price ₹ 2,896

- High / Low ₹ 2,905 / 2,000

- Stock P/E 28.0

- Book Value ₹ 1,110

- Dividend Yield 0.31 %

- ROCE 9.14 %

- ROE 8.94 %

- Face Value ₹ 10.0

Latest expert estimates for stocks, RIL Target!

Brokerage houses regularly update their estimates based on various factors such as company performance, market conditions, and industry trends. The expected RIL Share target is 3105 in near future.

Open Free UpStox Demat account/ Trading Account

Open Free Sharekhan Demat Account / Trading Account

2. HDFC Bank: Blue Chip Stocks to Invest in India

HDFC Bank, a leading private sector bank in India, is renowned for its robust fundamentals, extensive branch network, and customer-centric approach. With a history of delivering strong financial performance and innovation in banking services, HDFC Bank stands as a pillar of trust and reliability in the Indian financial sector.

As a preferred choice for investors seeking stability and growth, HDFC Bank continues to set standards for excellence, driving sustainable value creation and contributing to the nation’s economic growth trajectory.

Financial Details:

- Market Cap ₹ 11,04,388 Cr.

- Current Price ₹ 1,455

- High / Low ₹ 1,758 / 1,380

- Stock P/E 16.2

- Book Value ₹ 519

- Dividend Yield 1.31 %

- ROCE 6.24 %

- ROE 17.1 %

- Face Value ₹ 1.00

Based on companies performance the expected target price of HDFC Bank is Rs. 1910 in near future.

3. Infosys Limited:

Infosys Limited, a global leader in technology consulting and outsourcing solutions, is synonymous with innovation, quality, and client satisfaction. With a rich legacy of delivering cutting-edge IT services, Infosys has established itself as a trailblazer in India’s IT industry. Its commitment to excellence, coupled with a culture of continuous improvement, enables Infosys to anticipate and meet the evolving needs of its clients worldwide.

As a top pick for investors seeking exposure to the technology sector, Infosys Limited embodies resilience, growth, and a relentless pursuit of excellence in the digital age.

Financial Details:

- Market Cap ₹ 6,86,864 Cr.

- Current Price ₹ 1,657

- High / Low ₹ 1,681 / 1,185

- Stock P/E 28.2

- Book Value ₹ 193

- Dividend Yield 2.05 %

- ROCE 40.5 %

- ROE 31.8 %

- Face Value ₹ 5.00

The stock may touch levels of Rs. 1850 in near future.

4. Tata Consultancy Services (TCS): Blue Chip Stocks to Invest in India

Tata Consultancy Services (TCS) stands as a beacon of excellence in the global IT services landscape. As part of the esteemed Tata Group, TCS has cemented its position as a market leader through innovation, customer-centricity, and operational excellence. With a relentless focus on delivering value to clients and stakeholders, TCS leverages cutting-edge technologies to drive digital transformation and empower businesses worldwide.

Renowned for its robust business model and track record of consistent growth, TCS remains a top choice for investors seeking exposure to the dynamic IT sector in India and beyond.

Financial Details:

- Market Cap ₹ 13,91,572 Cr.

- Current Price ₹ 3,801

- High / Low ₹ 3,965 / 3,070

- Stock P/E 30.5

- Book Value ₹ 275

- Dividend Yield 1.26 %

- ROCE 58.7 %

- ROE 46.9 %

- Face Value ₹ 1.00

The TCS stock is expected to reach levels of Rs. 4210 in near future.

5. ICICI Bank:

ICICI Bank, a stalwart in the Indian banking industry, epitomizes trust, reliability, and innovation. With a diverse portfolio of financial products and services, ICICI Bank caters to the evolving needs of its customers while maintaining a strong digital presence. Renowned for its customer-centric approach and robust financial performance, ICICI Bank continues to set benchmarks for excellence in the banking sector.

As a preferred choice for investors seeking stability and growth, ICICI Bank’s steadfast commitment to operational efficiency and risk management underscores its position as a blue-chip stock in the Indian market.

Financial Details:

- Market Cap ₹ 7,13,107 Cr.

- Current Price ₹ 1,016

- High / Low ₹ 1,067 / 796

- Stock P/E 16.8

- Book Value ₹ 307

- Dividend Yield 0.79 %

- ROCE 6.32 %

- ROE 17.2 %

- Face Value ₹ 2.00

The expected target price of ICICI bank is Rs. 1211 in coming months.

6. Bharti Airtel: Blue Chip Stocks to Invest in India

Bharti Airtel, a leading telecommunications company in India, is synonymous with connectivity, innovation, and customer-centricity. With a comprehensive range of services including mobile, broadband, and digital TV, Bharti Airtel has transformed the way millions of Indians communicate and access information.

Through strategic investments in network infrastructure and technology, Bharti Airtel continues to expand its reach and enhance the quality of its services, positioning itself as a market leader in India’s rapidly evolving telecom industry. As a beacon of reliability and innovation, Bharti Airtel presents investors with an opportunity to capitalize on the burgeoning demand for connectivity and digital services in one of the world’s largest telecommunications markets.

Financial Details:

- Market Cap ₹ 6,84,028 Cr.

- Current Price ₹ 1,162

- High / Low ₹ 1,201 / 736

- Stock P/E 63.6

- Book Value ₹ 138

- Dividend Yield 0.34 %

- ROCE 12.3 %

- ROE 12.0 %

- Face Value ₹ 5.00

The expected target price of Bharti Airtel is Rs. 1415 in coming months.

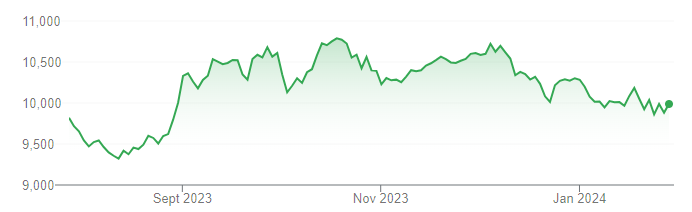

7. Maruti Suzuki India Limited:

Maruti Suzuki India Limited, a cornerstone of the Indian automotive industry, epitomizes excellence, reliability, and innovation. As the largest car manufacturer in India, Maruti Suzuki has redefined mobility for millions of Indians with its diverse portfolio of cars catering to various segments of the market.

Renowned for its commitment to quality, safety, and customer satisfaction, Maruti Suzuki has established a formidable distribution network and service infrastructure across the country, ensuring seamless ownership experiences for its customers.

With a track record of consistent growth and market leadership, Maruti Suzuki remains a top choice for investors seeking exposure to India’s dynamic automotive sector and its potential for sustained expansion in the years to come.

Financial Details:

- Market Cap ₹ 3,13,948 Cr.

- Current Price ₹ 9,991

- High / Low ₹ 10,933 / 8,127

- Stock P/E 27.7

- Book Value ₹ 2,178

- Dividend Yield 0.90 %

- ROCE 14.5 %

- ROE 11.5 %

- Face Value ₹ 5.00

The expected target price of Maruti Suzuki India Limited is Rs. 1120 in coming days.

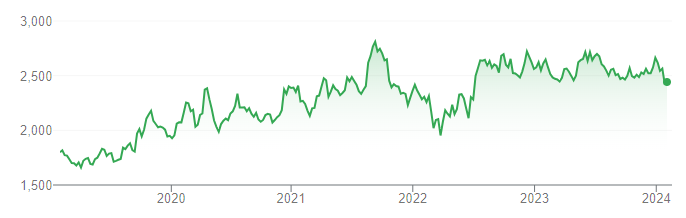

8. Asian Paints Limited: Blue Chip Stocks to Invest in India

Asian Paints Limited stands tall as India’s leading paint company, synonymous with quality, innovation, and customer trust. With a diverse portfolio of decorative and industrial coatings, Asian Paints has transformed millions of homes and commercial spaces across the country. Renowned for its focus on product innovation, sustainability, and customer engagement, Asian Paints continues to set industry benchmarks and strengthen its market leadership position.

Through strategic investments in research and development and a robust distribution network, Asian Paints remains at the forefront of India’s vibrant paints and coatings industry. As a blue-chip stock, Asian Paints presents investors with an opportunity to participate in the growth story of India’s booming construction and home improvement sector.

Financial Details:

- Market Cap ₹ 2,85,428 Cr.

- Current Price ₹ 2,976

- High / Low ₹ 3,568 / 2,694

- Stock P/E 52.3

- Book Value ₹ 173

- Dividend Yield 0.86 %

- ROCE 34.4 %

- ROE 27.7 %

- Face Value ₹ 1.00

The expected target price of Asian Paints is Rs. 3500 in near future.

9. Reliance Retail Ventures Limited (RRVL):

Reliance Retail Ventures Limited (RRVL), a subsidiary of Reliance Industries Limited. It emerges as India’s premier retail powerhouse, epitomizing innovation, scale, and customer-centricity. It’s a diverse portfolio of retail formats spanning groceries, fashion, electronics, and digital services. RRVL has redefined the retail landscape in India, catering to the diverse needs and preferences of consumers across the country. Through strategic alliances, technological advancements, and relentless focus on operational excellence, RRVL continues to expand its footprint and capture market share in India’s burgeoning retail sector.

As a key player in India’s retail revolution, RRVL offers investors an opportunity to partake in the country’s consumption story and capitalize on the immense growth potential of its retail industry.

Financial Details:

The expected target price of RRVL is Rs. 3150 in coming days.

10. Hindustan Unilever Limited (HUL):

Hindustan Unilever Limited (HUL) stands as India’s largest FMCG (Fast Moving Consumer Goods) company, symbolizing innovation, sustainability, and consumer trust. With a vast portfolio of household and personal care products, HUL has been an integral part of Indian households for decades, offering quality products that cater to diverse consumer needs. Renowned for its strong brand equity, extensive distribution network, and commitment to social responsibility, HUL continues to lead the FMCG industry in India and beyond.

Through continuous innovation, strategic acquisitions, and a deep understanding of consumer preferences, HUL sustains its market leadership and delivers consistent value to shareholders. As a blue-chip stock, HUL offers investors an opportunity to participate in India’s consumption story and benefit from the country’s demographic dividend and growing consumer aspirations.

Financial Details:

- Market Cap ₹ 5,73,909 Cr.

- Current Price ₹ 2,444

- High / Low ₹ 2,770 / 2,365

- Stock P/E 55.6

- Book Value ₹ 214

- Dividend Yield 1.60 %

- ROCE 26.6 %

- ROE 20.5 %

- Face Value ₹ 1.00

The expected target price of HUL is Rs. 3140 in coming months.

Conclusion

Investing in blue-chip stocks offers a blend of stability and growth potential for investors. However, it’s essential to conduct thorough research and consult with financial advisors before making investment decisions. Stay informed about market trends and company performance to navigate the Indian stock market successfully.

- Top 10 Best Stocks to invest in 2024 for a year

- Top 10 Best Penny Stocks under 20 Rs. in India for 2024

- Stock Market Crash Today; Steps to recover your loss

- Top 10 Stocks to invest in 2024 Under 300 Rs

- Top 10 Stocks To Invest Under 100 Rs

- Top 10 Best Personal Loan Apps for low CIBIL Score

- Top 10 Penny Stocks to invest under Rupee 1

- Top 10 Best Penny Stocks under 10 Rs. in India for 2024

- Top 10 Best Dividend Stocks to invest

- Top 10 Stock broking companies and mobile trading app in India

- Top 5 Life Insurance Companies in India and List of claim settlement ratio, Tips to choose a best life insurance company

- Top 10 Stocks to invest

Read Category-wise posts

Banking | Bank Account | Bank Deposit Schemes | Loans | Bank Cards | Credit Cards | Debit Cards | Search IFSC & MCLR Code | Insurance | Bank Jobs and Exams | Stock Market | GST | EMI Calculator